The Croatian National Bank recently published a report which discovered interesting, but not unexpected, changes in consumer behaviour in the payment services market brought about by the COVID-19 pandemic.(1) The pandemic has influenced not only world markets and economies, but also the everyday lives of market participants and their payment habits.

Croatian citizens normally prefer physical shopping and cash payment, which is the most represented method of paying for goods and services in retail. However, the pandemic has accelerated the growth rate of online shopping and the proportion of contactless payments compared with cash. The report noted a 34% increase in online transactions in 2020 compared with the same period in 2019, while the value of those transactions increased by 38%.

Increase in amount and volume of online shopping

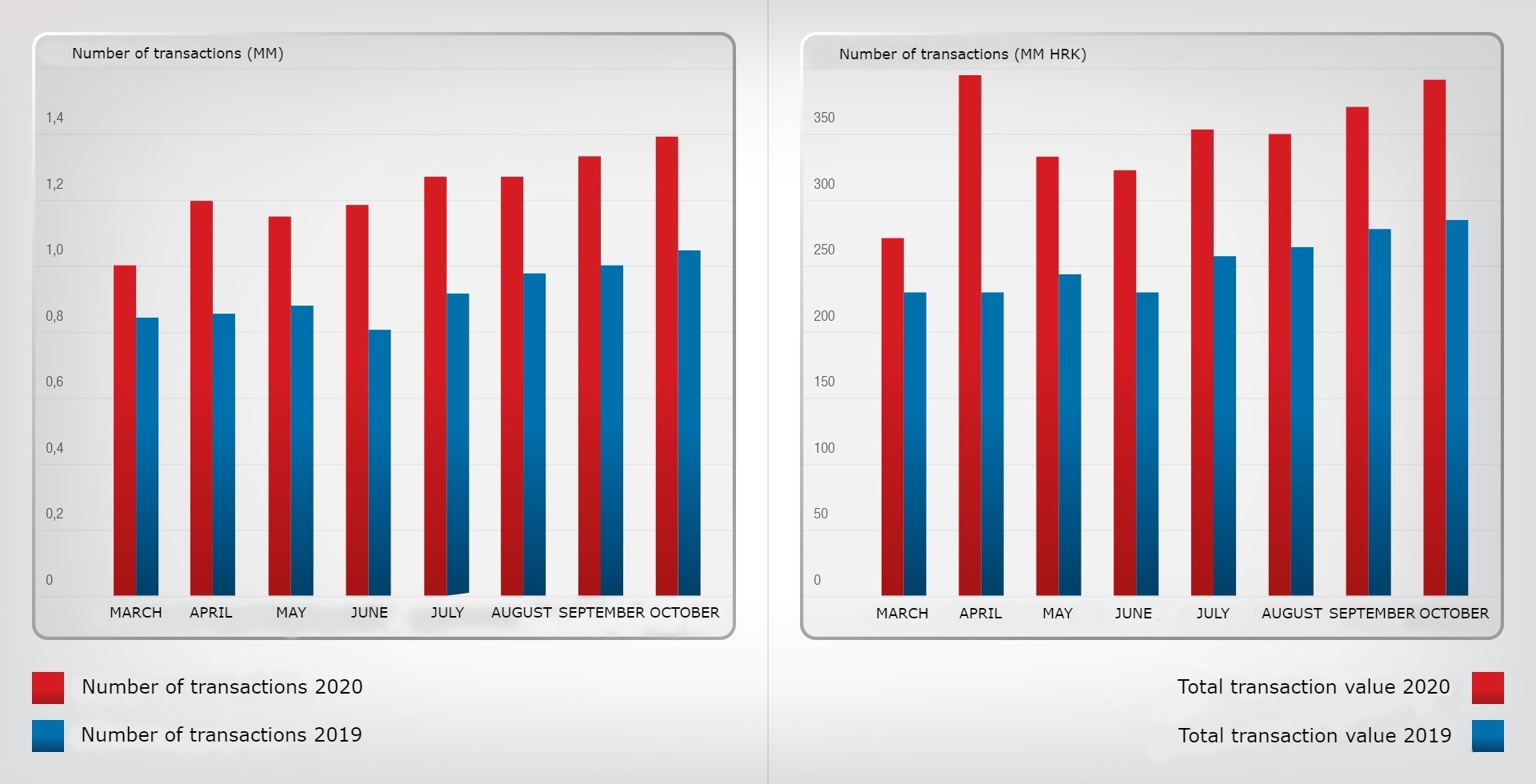

In 2020 there was a clear increase in online shopping, especially in April 2020 when Croatia was under a strict lockdown (Figure 1). There were 18.84% more transactions in April 2020 than in March 2020, while the value of online transactions in April 2020 was 46.67% higher than in March 2020. Citizens used online stores more often and for larger purchases as many physical stores were unavailable at the time. However, the change turned into a trend – Summer 2020 brought a stable epidemiological situation that removed the need for lockdowns and other strict measures yet the rise in online transactions remained.

Figure 1: online shopping trends in 2019 and 2020

Figure 1: online shopping trends in 2019 and 2020

Increase in contactless payments

The most used payment methods in Croatia are payments by cards and cash. Any card payment transaction is a complex and technically demanding process and contactless payment methods require specific devices and support from both the card issuer and the transaction acquirer.

In the past five years, the number of contactless payment cards on the market has increased by an average of 21.6% per year and the number of contactless electronic funds transfer at point of sale (EFTPOS) devices has increased by 44%. Consequently, in March 2020 55% of all payment cards on the market were contactless, while 80% of the EFTPOS devices available enabled contactless payment transactions.

At the end of April 2020, the Croatian National Bank issued a recommendation to banks and credit card companies to increase the maximum amount for contactless payment transactions from HRK100 to HRK250 (from approximately €15 to €30) to enable consumers to perform payments without physical contact. This affected the increase in total contactless payments since contactless cards already constituted the majority of cards issued and were well represented in everyday transactions. The limitation of HRK250 covered most usual transactions because the average payment transaction by card in Croatia is HRK225, while the average cash transaction is around HRK50 (€7).

The number of contactless card transactions between March 2020 and October 2020 grew by 76% and their value increased by as much as 161% compared with 2019. During the same period, there was a 29% decrease in the number of contact payment transactions and a 9% decrease in the value thereof.

Fewer foreign card transactions

Croatia's economy relies heavily on tourism. The 2020 tourist season was limited due to the pandemic and resulting travel restrictions and other measures. This is evidenced by the significant decrease in the number and amount of foreign card payments in July 2020 and August 2020 compared with the same months in 2019. Even though there were fewer such payments in March 2020 and April 2020, the fall was most evident in Summer 2020 when the strictest containment measures were applied.

Fewer cash payments, more card payments

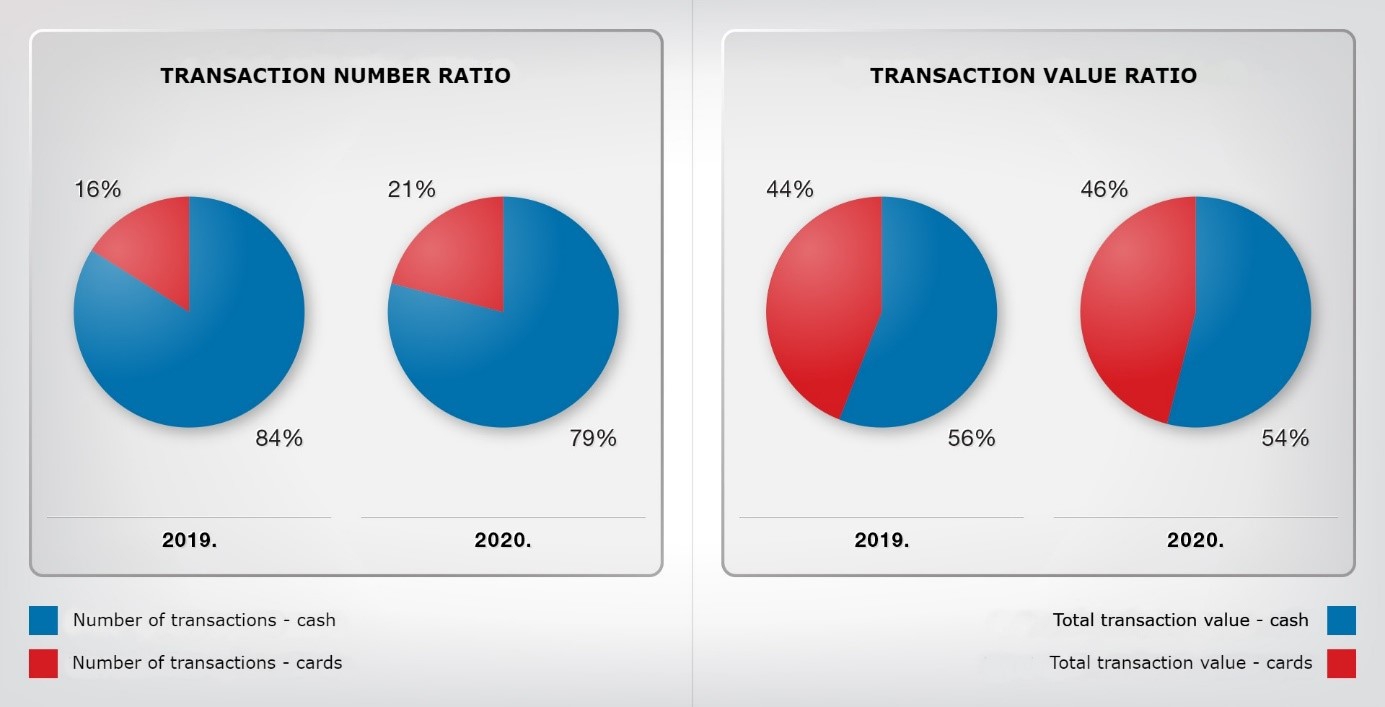

Cash has traditionally been the most represented payment method for buying goods and services in retail in Croatia. However, in recent years the proportion of cash payments in relation to card payments has been slowly but steadily decreasing.

At the beginning of 2020, the normal trend of mild growth in the proportion of card payments in the total number of fiscalised bills continued. However, while restrictive containment measures were in force between March 2020 and May 2020, the proportion of card payments increased more rapidly compared with the same period in 2019. After the removal of restrictive measures in Summer 2020, the increase slowed down again but remained at a higher level than the normal growth from previous years (Figure 2).

Figure 2: proportion of cash payments to card payments in 2019 and 2020

Figure 2: proportion of cash payments to card payments in 2019 and 2020

The pandemic resulted in a reduction of economic activity in Croatia and, consequently, a reduction of the expenditure of payment services users. This can be accounted for by the containment measures and citizens' caution due to the overall uncertainty regarding the course of the pandemic.

The COVID-19 situation initiated a strong trend of increased online shopping, which prevailed after protective measures were lifted. The same happened with contactless and cashless payments. The changes in citizens' payment habits brought about by the pandemic are already showing signs of turning into trends, further analysis of which is likely in the future.

Endnotes

(1) Influence of the COVID-19 Pandemic on Payment Habits in the Republic of Croatia.