Regulatory activity 2019

What may be on the regulatory agenda in 2020?

Comment

Before closing the books on 2019, registered investment advisers and funds should take a look back at the activity undertaken by the SEC and its staff in the past year and carefully consider steps to be taken to implement new and amended regulations adopted by the SEC throughout the year. The start of a new year is also a good time to evaluate what remains on the SEC's regulatory agenda.

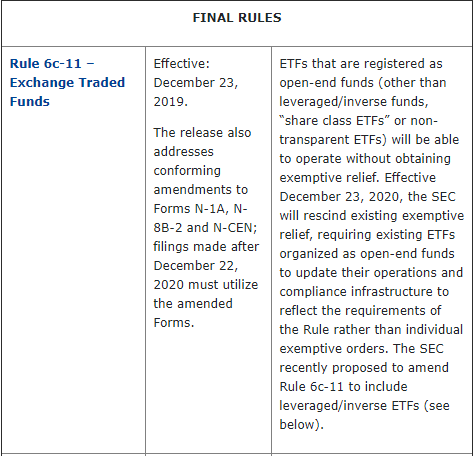

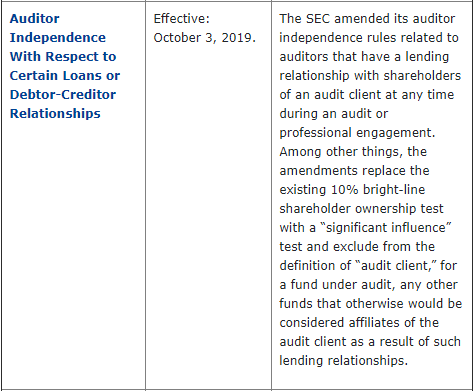

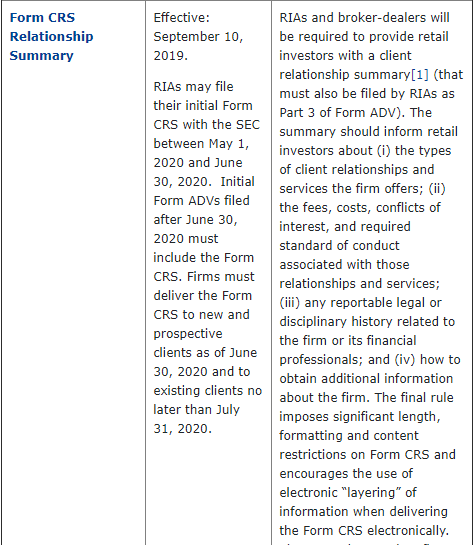

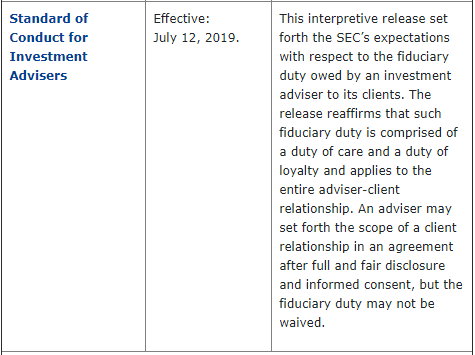

2019 was a busy year for the SEC staff across several Divisions. Set forth below is a summary of key regulatory activity that will affect advisers and funds.

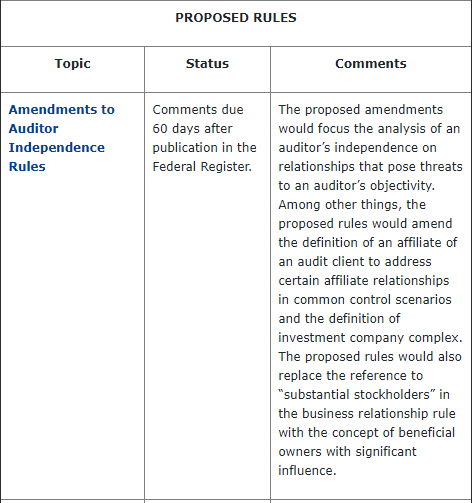

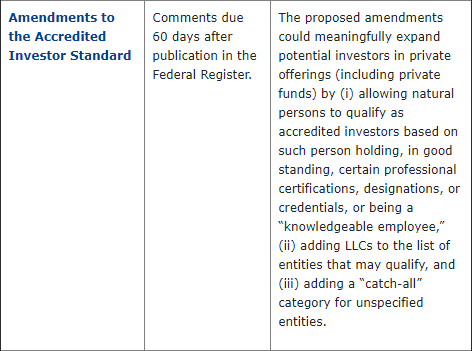

What may be on the regulatory agenda in 2020?

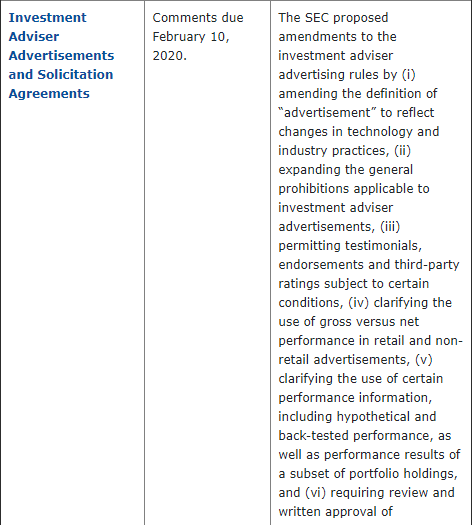

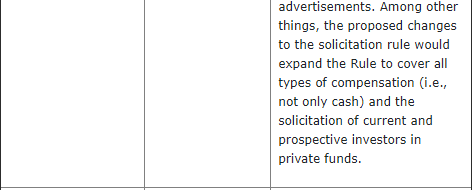

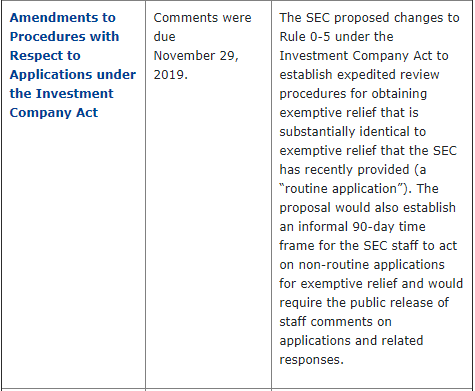

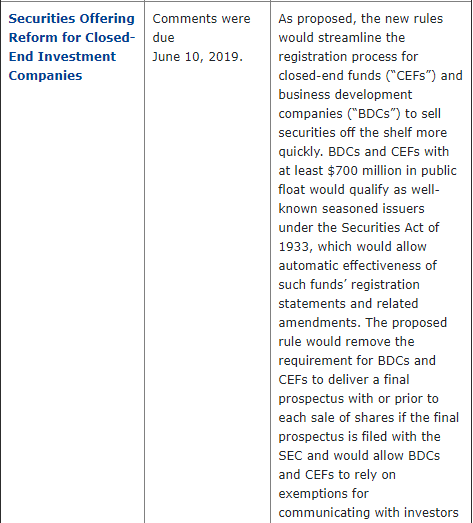

The SEC staff has identified certain proposed regulations in the SEC's most recent regulatory flexibility agenda. Members of the SEC staff have also identified areas of focus that could result in additional regulatory refinements during 2020.

- Transfer agents: The SEC staff is considering a proposal to update the current transfer agent regulatory regime. The SEC published advance notice of this rulemaking and a related concept release in December 2015, noting that the transfer agent regulations have remained essentially unchanged since adoption in 1977. Comments on the advance notice were due in April 2016, but the staff continued to receive comments until at least April 2018.

- Investment company shareholder reports: The Division of Investment Management is actively working on a proposal to streamline shareholder reports for registered investment companies.

- Custody rule: Rule 206(4)-2 under the Investment Advisers Act (the "Custody Rule") was last amended in 2009 and, since then, has been the subject of on-going staff guidance and numerous enforcement actions. The staff of the Division of Investment Management is considering amendments to the Custody Rule that would improve, streamline and modernize the regulations governing custody of client funds or securities by investment advisers.

- Rule 13F thresholds: The SEC staff is considering amendments to the thresholds for Form 13F filers.

- Valuation guidance for funds: Valuation guidance under the Investment Company Act is dated. The last time the SEC provided significant guidance in this area was in an accounting release in 1970, but the use of more complex instruments and technological advances in the intervening years, together with interpretations of existing guidance by SEC staff in enforcement and regulatory releases, makes valuation compliance challenging. The staff should consider a proposal to streamline and refine the existing regulatory guidance.

- Affiliated securities lending: The Division of Investment Management has established a team to consider the ability of registered funds to use affiliated securities lending agents and the resulting conflicts of interest. Among other things, the staff has asked for input on whether a fund should be limited in its ability to use an affiliated securities lending agent and whether additional disclosure regarding these programs would be useful for fund investors.

The compliance staff of investment advisers and funds are busy ensuring that their firms are prepared for new rules and forms that will be effective in 2020, but the SEC staff does not seem to be slowing down. Compliance officers (as well as operational teams and service providers) are in store for another busy year in 2020 and should ensure they are well staffed to address the changes ahead.

For further information on this topic please contact Susan I Gault-Brown at Morrison & Foerster LLP's Washington DC office by telephone (+1 202 887 1500) or email ([email protected]). Alternatively, please contact Kelley Howes at Morrison & Foerster LLP's Denver CO office by telephone (+1 212 468 8000) or email ([email protected]). The Morrison & Foerster LLP website can be accessed at www.mofo.com.

This article has been reproduced in its original format from Lexology – www.Lexology.com.