This article was first published by the International Law Office, a premium online legal update service for major companies and law firms worldwide. Register for a free subscription.

China's antitrust enforcement agencies were reorganised in 2018 (for further details please see "Merger control review 2018"). As such, new legislation and enforcement actions in 2019 attracted significant attention from practitioners and in-house counsel, with a view to gaining an insight into the new agency's enforcement trends and priorities (if any). This article underlines the most significant developments in legislation, public enforcement and private litigation in 2019.

Anti-monopoly Law (Draft Amendment)

To respond to the challenges encountered in the enforcement of anti-monopoly law and to satisfy the needs of China's evolving economic activities, China's new antitrust agency, the State Administration for Market Regulation (SAMR), expended considerable effort amending the Anti-monopoly Law (AML) in 2019.

On 2 January 2020 the SAMR published a draft amendment to the AML for public comment. Although the draft amendment is far from the final version, its changes are worth scrutinising and shed light on possible future enforcement trends. Business operators are advised to conduct internal risk assessments in consideration of these possible changes.

Five key changes in the draft amendment are summarised below.

- First, a provision has been added on how to determine dominance in the internet sector. The proposed factors include network effects, economy of scale, lock-in effect and capability of controlling and processing data. As such, it has been once again highlighted that the internet sector has become, and may continue to be for some time, one of China's enforcement priorities.

- Second, for the merger control regime, a new rule to stop the clock of the review process has been added, although no details of the stop-the-clock rule are provided. This revision may be a response to the fact that in cases where remedies are negotiated, the statutory review period is usually inadequate for the SAMR to reach a final decision.

- Third, pursuant to the draft amendment, antitrust enforcement agencies could seek assistance from public security personnel in the course of antitrust investigations. The explicit provision for the use of police force signals a potential reinforcement of inspection and investigative measures in the public enforcement of the AML, especially for dawn raid investigations.

- Fourth, statutory punishment would be more stringent for unimplemented monopoly agreements. Under the current AML, business operators which have concluded but not implemented the monopoly agreement face a potential fine of up to Rmb500,000 (approximately $70,000), together with confiscation of illegal gains. Under the draft amendment, the statutory fine would be increased to Rmb50,000 million (approximately $7 million) for unimplemented monopoly agreements and for business operators with no revenue in the preceding year.

- Fifth, statutory punishments would become harsher for gun-jumping in the merger control regime. The fact that the current level of punishment has no deterring effect at all is a major source of criticism, as the fine is limited to Rmb500,000 (approximately $70,000). The draft amendment would raise the penalty level to "below 10% of the turnover in the preceding year".

Three new regulations

The most notable legislative achievement in 2019 was the SAMR's promulgation of three new antitrust regulations, which took effect on 1 September 2019:

- the Interim Provisions on the Prohibition of Monopoly Agreements (the Monopoly Agreement Regulation);

- the Interim Provisions on the Prohibition of Abuse of Dominant Market Positions (the Abuse of Market Dominance Regulation); and

- the Interim Provisions on the Prohibition of Abuse of Administrative Power in Eliminating or Restricting Competition (the Administrative Abuse Regulation).

The new regulations aim to:

- unify rules which were fragmented prior to the reorganisation of China's antitrust agencies; and

- provide clear guidance to business operators on compliance complying with China's antitrust rules and enforcement agencies for undertaking enforcement actions in a standardised manner.

The new regulations are more self-contained compared with the previous rules, in that they combine both substantive and procedural provisions. Before the reorganisation, the previous antitrust agencies (ie, the National Development and Reform Commission (NDRC) and the State Administration for Industry and Commerce (SAIC)) issued separate regulations to deal with substantive and procedural issues, respectively.

Further, based on experience accumulated from past enforcement actions, the new regulations have clarified the SAMR's position on a few outstanding issues. For example, the Monopoly Agreement Regulation implicitly clarifies that the per se approach is to be taken for the five types of horizontal monopoly agreement and resale price maintenance, which are explicitly enumerated in the AML, and the rule of reason approach for other types of monopoly agreement which are not enumerated in the AML. Further, it is made clear that the commitment regime is inapplicable to certain hardcore restrictions, including price fixing, the restriction of sales and market partitioning between competitors. Detailed rules on the leniency regime have also been added in the Monopoly Agreement Regulation.

In addition, the new regulations demonstrate the SAMR's increased focus on a few emerging issues. For instance, there is a provision in the Abuse of Market Dominance Regulation that specifically addresses determination of market dominance in the internet sector and another provision pertaining solely to assessing market dominance in intellectual property. The Abuse of Market Dominance Regulation also outlines factors the agencies will take into consideration in determining collective dominance, such as market structure, market transparency, product homogeneity and behaviour uniformity.

Notice on antitrust enforcement authorisation

Before the reorganisation of China's antitrust agencies, a discrepancy existed between the NDRC's and the SAIC's authorisation of antitrust enforcement to provincial agencies. The SAIC took a case-by-case authorisation approach, while the NDRC took a general authorisation approach. At the beginning of 2019, the SAMR released a notice to adopt the general authorisation approach, which established China's two-level antitrust enforcement system involving the national and provincial level enforcement agencies working in parallel.

This notice also set up the working mechanism for authorisation, including providing general authorisation to provincial-level enforcement departments, the designation of enforcement powers, commissioned investigations and cooperation in investigations. To some extent, these rules are also incorporated in the Monopoly Agreement Regulation and the Abuse of Market Dominance Regulation.

Notably, the unified general authorisation system will confer more autonomy on provincial antitrust agencies to initiate investigations. As such, implicit competition between provincial agencies may encourage more enforcement activities going forward.

Draft Guidelines on Antitrust Compliance of Business Operators

No official version of the antitrust guidelines was released in 2019, but legislative efforts were made in guideline drafting. On 28 November 2019 the SAMR published the draft Guidelines on Antitrust Compliance of Business Operators for public comment. This implies that the SAMR attaches great importance to developing antitrust compliance and enforcing the AML by investigating and penalising business operators.

The draft guidelines are mainly composed of general principles, a compliance management system, key compliance risks and details of how to manage compliance risks and safeguard compliance management. They also aim to provide business operators with guidance on establishing a sound internal antitrust compliance system. However, how a sound compliance system may affect business operators in antitrust enforcement is not articulated. For instance, whether the establishment of a sound internal compliance system could reduce the legal liabilities of business operators in the course of antitrust investigations remains unclear.

Merger control

Despite the issues of China-US trade friction and sluggish global economic growth, the number of merger filings in 2019 was approximately the same as in 2018. In total, the SAMR completed reviews of 432 merger filings in 2019, slightly lower than 448 in 2018. In 2019, remedial conditions were imposed in five cases (compared with four remedy cases in 2018) and no prohibition decisions were made.

In all five remedy cases (ie, KLA Tencor v Orbotech, Cargotec v TTS, II-VI Incorporated v Finisar, Zhejiang Huayuan Biotechnology v Royal DSM and Novelis v Aleris) the filing parties withdrew and refiled with the SAMR; the average time from submission of filing to issue of approval was 387 days. Of the five remedy cases, hold-separate remedies were imposed in three cases, structural remedy was imposed in one case and behavioural remedy was imposed in one case. The supervision period was set as five years in three cases and three years in one case (for a comparison between 2019 and previous years, please see Figure 1).

Figure 1. Mergers in China from 2008 to 2019

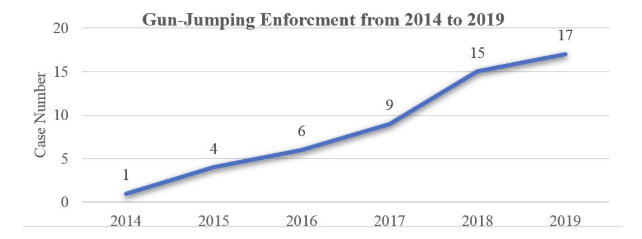

Enforcement against gun-jumping was continuously strengthened in 2019, with 17 fines issued. This trend is reflected in the Figure 2, which depicts the number of enforcement cases each year since 2014 when penalties on gun-jumping were first made public. Although the penalty on gun-jumping is limited to Rmb500,00 (approximately $70,000) under existing laws, the potential reputational harm on gun-jumpers may produce some deterring effects. Specifically, as the SAMR publishes all penalty decisions on its official website, the violators' corporate image will be more or less damaged. Further, if a penalised company is a listed company, its stock prices may react negatively. Even for non-listed companies, such penalty may also affect their future financing.

Figure 2. Gun-jumping enforcement from 2014 to 2019

Enforcement against monopoly agreement and abuse of market dominance

In 2019 the SAMR published enforcement decisions in 18 cases, most of which were issued under the provincial Administration for Market Regulation (provincial AMR). The 18 decisions include two investigation termination decisions, three investigation suspension decisions and 13 penalty decisions. Seven cases involved the abuse of a market dominant position, eight cases concerned horizontal monopoly agreements and three cases pertained to vertical monopoly agreements. Sectors involved in the investigations include pharmaceuticals, automobile, construction materials, public utilities and consumer goods.

Penalties imposed on foreign-invested companies include Jiangsu AMR's fines against Toyota China for resale price maintenance and Shanghai AMR's fine against Eastman China for abuse of market dominance. The former fine was fixed at 2% of Toyota's turnover in the preceding year in Jiangsu province or Rmb87,613,059.48 (approximately $12,516,100). The latter fine amounted to 5% of Eastman China's turnover in the preceding year or Rmb24,378,711.35 (approximately $3,482,600).

With regard to behaviour investigated in 2019, the decision in Eastman showcased novelty to some extent. Specifically, it was the first case where the minimum purchase requirement and take-or-pay clause were found in violation of the AML in China. In addition, the investigation termination decision on Horien and Hydron by Shanghai AMR and the investigation suspension decision on Lenovo by Beijing AMR evidenced that the commitment regime is applicable to vertical monopoly agreements in practice.

Antitrust case law

One significant change in antitrust judicial practice in 2019 was that the Supreme People's Court became the second-instance court for all antitrust litigation cases from 1 January 2019 onward, regardless of whether the first-instance court was an intermediate people's court or a high people's court.

There are currently no official statistics on the number of antitrust litigations in China in 2019. According to public sources, substantive judgments in antitrust litigations are few, and most high-profile cases such as Hitachi Metal and MLily remain pending.

One milestone case was Hainan Yutai, in which the Supreme People's Court addressed the longstanding conflict of approach between enforcement agencies and Chinese courts regarding resale price maintenance. Specifically, antitrust agencies in previous enforcement actions took a per se illegal approach to resale price maintenance, while Chinese courts adopted a rule of reason approach, as manifested in cases such as Johnson-Johnson, Hankook and Gree. In Hannan Yutai, adjudicated in an administrative retrial by the Supreme People's Court (published in 2019), the court recognised that the legal standards applicable to vertical monopoly agreements are different in public enforcement and private proceedings, which in a sense dispelled a lot of expectations that the SAMR to change its per se approach.

Another landmark jurisdictional ruling was rendered by the Supreme People's Court in Shell, which addressed the issue of the arbitrability of antitrust civil disputes. For a few years, the topic of whether antitrust civil disputes could be arbitrated was hotly debated in China. While there were few precedential decisions in connection with this issue for people to better understand what China's judicial position was, the local courts came to different conclusions on this issue in the past. Nevertheless, the Supreme People's Court made clear its stance in the abovementioned ruling that arbitration clauses could not preclude the jurisdiction of Chinese courts over antitrust civil disputes. The ruling can be viewed as an official judicial voice in this regard and may be relied on.

The Internet, automobile, public utilities and consumer goods sectors are expected to remain on China's antitrust enforcement radars in 2020. Public enforcement is foreseen to be more active (given that the provincial AMRs have completed their institutional reform and are ready to flex their muscles), many publicised high-profile cases may come to an end and improvements have been made to the reporting and leniency regimes to facilitate finding of antitrust violations. Merger control activities are expected to be stable, with enforcement against gun-jumping likely to be strengthened further. In the judicial arena, courts' opinions on complicated issues (eg, the essential facility doctrine), platform markets and the pass-on defence may be looked on closely in high-profile cases.