This update looks back at the key competition law developments in New Zealand during 2017.

Legislative reform

Cartels Act enacted into law

After a six-year journey through Parliament, the Commerce (Cartels and Other Matters) Amendment Act 2017 received royal assent on August 14 2017. The act made a number of fundamental changes to the Commerce Act 1986 for example:

- it expanded the scope of the price-fixing prohibition to prohibit market allocation and output restriction arrangements between competitors (now known as the prohibition on cartel provisions); and

- it introduced new exemptions to the cartel prohibition – namely, a new exemption for collaborative activities (to replace the previous joint-venture exemption and provide a more flexible and fit for purpose exemption for pro-competitive collaboration between competitors) and a new exemption for cartel provisions that are included in vertical supply contracts (where certain requirements are met).

See more details of these changes here.

The enactment of the Cartels Act was a positive step for businesses as:

- it ended six years of uncertainty while it languished before Parliament; and

- it introduced exemptions that are better formulated to enable competitors to work together in appropriate circumstances.

Commerce Commission market study powers

In June 2017 the then-commerce and consumer affairs minister announced that the National-led government recommended empowering the Commerce Commission to undertake market studies at the minister's initiation.(1) Until then, the commission had no power to undertake those studies of its own volition due to government concerns regarding the cost to businesses of responding to market studies and the risk of the commission engaging in unnecessary 'fishing expeditions'.(2)

The new Labour-led government stated that it is "quite keen to give the Commerce Commission the power to self-initiate… if the Commerce Commission believes there's a public interest in looking into a specific market, then we should take the politics out and let them do it".(3)

The government favoured introducing such power before the end of 2018, seemingly as a political response to calls for an inquiry into New Zealand petrol prices.

It is debatable whether giving the commission the ability to initiate market studies would call for more or less political considerations when deciding which industries to study. In one sense, enabling the commission to self-initiate reduces political accountability for the costs and outcomes (or lack of outcomes, based on overseas experience of similar regimes) and may increase the prospect of a study lacking the political backing necessary to achieve any consequential policy reforms off of the back of the findings.

On the other hand, enabling the commission to self-initiate market studies would grant it greater freedom than what it has within the narrow ambit of its merger, cartel or market power enforcement powers to identify and focus on markets and businesses that it considers would benefit from a wider market examination. While political accountability and targeted focus are proven benefits of studies initiated by the minister, budget and resource constraints are likely to limit the number and scope of commission self-initiated studies. Policy makers will reflect on other mechanisms to ensure that the regime includes the correct level of checks and balances.

Market power reform on hold – but for how long?

Due to the Commerce Commission's long-stated concerns about New Zealand's existing prohibition on taking advantage of market power, the Ministry of Business, Innovation and Employment (MBIE) commenced a targeted review of that prohibition in November 2015.

Following that review, it was announced in June 2017 that any recommendations relating to the market power prohibition would be postponed until June 2018 because the MBIE and the then National-led government considered it difficult to identify where issues with the market power prohibition had led to actual harm to competition.

The Labour Party's pre-election policy manifesto outlined its intention to review the Commerce Act urgently specifically the market power prohibition which was deemed inadequate.

The Labour-led government will likely follow the Australian model when seeking to reform the prohibition. Australian law now prohibits firms with a substantial degree of market power from engaging in "conduct that has the purpose, or has or is likely to have the effect, of substantially lessening competition" in a market.(4) Essentially, the reform would:

- remove the 'taking advantage' limb; and

- apply where a firm has an anti-competitive purpose or its conduct has an anti-competitive effect.

Australian legal advisers have described this change to the law as bold and controversial, and cite the lack of legislative guidance as creating uncertainty for businesses.(5)

Mergers and acquisitions

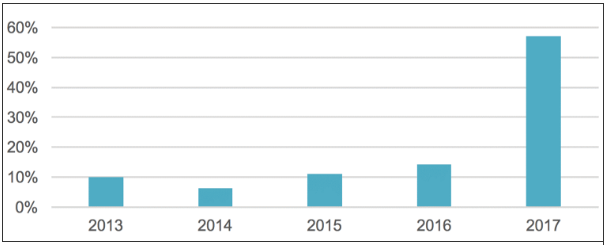

In 2017 the Commerce Commission adopted a more interventionist approach to mergers and acquisitions. In addition to a significant jump in the proportion of declined merger clearances (see chart below), the commission took its first merger enforcement proceedings since 2006 (in relation to a transaction that it had previously cleared in 2015, but was not implemented at that time).

Chart 1: proportion of declined clearances per year (of decisions made)

Responding to this increase in clearance declines, the commission chair stated that it was not a sign of change in process or approach rather, it reflected the challenging clearance applications that came before the commission in 2017.(6)

The declined clearances included the following:

- Sky and Vodafone declined due to concerns that the merged entity would leverage Sky's market power over premium live sports content to foreclose competition by other broadband and mobile competitors.(7)

- Vero and Tower declined as the merger would combine the second and third-largest personal insurers.(8) The commission held that the target would be more competitive either as a standalone company or under different ownership (in a competitive bid process) and remaining competitors would be insufficient to constrain unilateral and coordinated conduct between the merged entity and the larger insurer, Insurance Australia Group. The parties initiated an appeal of the commission's decision at the High Court, but this was abandoned in November 2017.

- Aon and Fire Protection Inspection Services declined on the basis that the parties, as the largest suppliers of fire inspection services in New Zealand, would likely foreclose access to fire inspection services in future, and remaining competitors would be insufficient to constrain the merged entity.

The commission also declined clearance for the proposed merger of newspaper and online news publishers Fairfax New Zealand and NZME. In its decision, the commission held that:

- it was unsatisfied that the merger would not substantially lessen competition on the readers' side of the two-sided market for the supply of free online national news, in separate markets for Sunday newspapers and community newspapers in certain overlap areas; and

- the merger's significant quantified net public benefits of up to NZ$200 million (largely in the form of operational synergies) were outweighed by an unquantifiable and detrimental effect on New Zealand's democractic status due to the loss of media plurality and quality.

The parties appealed the commission's decision to the High Court in October 2017 a judgment has yet to be published.

Merger investigations and proceedings

The Commerce Commission has confirmed that it is conducting several investigation into mergers where the parties declined to seek commission clearance.(9)

The most high-profile investigation concerns Platinum Equity's acquisition of OfficeMax, which would combine Winc (formerly Staples) and OfficeMax under common ownership. While the combination received commission clearance in 2015, it was not implemented within the 12-month clearance protection period, as the US-owned part of that global merger was blocked.

Contrary to its earlier position, the commission recently decided that the combination would substantially lessen competition between suppliers of stationery to large corporate and government customers, and joined injunction proceedings initiated by third-party competing bidder Complete Office Supplies to prevent the transaction from completing.

This is the first time that the commission has taken proceedings opposing a merger since 2006. Although the Australian Competition and Consumer Commission advised that it will not oppose the deal in Australia, the commission cited different market dynamics in New Zealand.(10) Fuji Xerox's recent difficulties(11) including its suspension from the government's office suppliers' panel(12) likely contributed to the commission's revised stance.

The Platinum-OfficeMax proceedings are scheduled for June 2018.

Cartel enforcement

Real estate agent price fixing

During 2017 the Commerce Commission continued its enforcement against alleged collusive conduct between real estate agencies – with a number of real estate agencies continuing to admit liability and reach settlements with the commission(13) bringing the total agreed penalties to nearly NZ$20 million (see Table 1).

Table 1: real estate agency settled price fixing penalties

|

Barfoot and Thompson |

$2.6 million |

|

Harcourts Group |

$2.6 million |

|

LJ Hooker |

$2.5 million |

|

Ray White |

$2.2 million |

|

Bayleys |

$2.2 million |

|

Property Page Ltd |

$100,000 |

|

Online Realty Ltd |

$1.05 million |

|

Lugton's Ltd |

$1 million |

|

Success Realty |

$900,000 |

|

Manawatu 1994 |

$1.25 million |

|

Unique Realty |

$1.25 million |

|

Property Brokers |

$1.45 million |

However, several real estate agents chose not to settle with the Commerce Commission, including Hamilton-based real estate agents Lodge and Monarch. The proceedings went to a contested High Court hearing in September 2017.

In November 2017 the High Court released its judgment dismissing the commission's claims, despite other real estate agents involved in the same alleged conduct having admitted liability.(14) The High Court held that although the defendants had entered into an arrangement and given effect to it, the arrangement had no purpose to fix, control or maintain the price of real estate sales or advertising services because "nothing in the arrangement… constrains any freedom to charge any price to any individual vendor on any individual transaction" (ie, the agencies retained discretion to deviate from their agreement).

The commission announced that it will appeal this decision to the Court of Appeal, stating that it "raises significant legal issues that warrant an appeal".

Leniency regime

The Commerce Commission confirmed that it had received several leniency applications in 2017 and is reviewing its leniency policy to ensure maximum effectiveness.

Authorising anti-competitive practices

In 2017 the Commerce Commission considered two applications for authorisation of anti-competitive practices:

- In April the commission authorised the Nelson and Tasman councils' application to operate the two landfills in the Nelson-Tasman region jointly, subject to imposing conditions requiring any surpluses to be used solely to fund each councils' waste-related activities.

- In September the commission received an authorisation application for collective bargaining from the Waikato - Bay of Plenty Chicken Growers Association. On behalf of its members, the association is seeking to collectively negotiate the terms and conditions by which members supply chicken growing services to Inghams. A draft determination issued in November 2017 reached a preliminary view to authorise the application, with a final determination expected in the coming months.

This article was first published by the International Law Office, a premium online legal update service for major companies and law firms worldwide. Register for a free subscription.

For further information on this topic please contact Sarah Keene or Troy Pilkington at Russell McVeagh by telephone (+64 9 367 8000) or email ([email protected] or [email protected]). The Russell McVeagh website can be accessed at www.russellmcveagh.co.nz.

Endnotes

(1) Ministry of Business, Innovation and Employment "Targeted Review of the Commerce Act 1986".

(2) For further details please see here.

(3) Hamish Rutherford "Competition watchdog could get power to conduct probes without Government approval" (December 4 2017) Stuff.

(4) Section 46 of the Australian Competition and Consumer Law Act 2010.

(5) For example, see Allens "The Government's proposed amendments to Australia's competition laws" and King & Wood Mallesons "Section 46 changes to crack down on misuse of market power in Australian competition law" (September 5 2016).

(6) "Vero's Tower takeover appeal to be heard in January" (September 5 2017) The New Zealand Herald.

(7) Decision [2017] NZCC 1 and 2 Vodafone Europe BV and Sky Network Television Limited at [X2].

(8) Decision [2017] NZCC 18 Vero Insurance New Zealand Limited and Tower Limited at [X2].

(9) Commerce Commission Annual Report 2017, page 14. Available here.

(10) Susan Edmunds "ComCom to continue with court action to block merger, despite Aussie green light" (December 5 2017) Stuff.

(11) For example, see Tom Pullar-Strecker "Serious Fraud Office says new investigation under way into Fuji Xerox" (October 3 2017) Stuff.

(12) Fiona Rotherham "Fuji Xerox canned from one government contract, suspended from another" (October 2 2017) National Business Review.

(13) In April 2017 Property Brokers Ltd and its director Tim Mordaunt reached a court-approved settlement with the Commerce Commission to pay penalties of NZ$1.45 million and NZ$50,000 for agreeing with competing real estate agencies in the Manawatu region to pass on to customers the full cost of advertising a property on Trade Me.

(14) This includes Online Realty being handed a penalty of NZ$1.05 million (see Table 1).