A commonly negotiated provision in M&A transactions is the clause that provides for the buyer's indemnity right, which, among other things, applies in relation to the liabilities of the target whose existence is based on a past event prior to the closing of the deal. This clause aims to limit the liability of the parties involved in the transaction for losses relating to the company or the asset traded and can be structured in several ways.

A relevant decision by the Sao Paulo Court of Justice highlighted the importance of expressly regulating this type of clause in M&A contracts. In the case, a contract for the purchase and sale of shares representing 26.05% of a limited company's capital was entered into. Pursuant to this agreement, the buyers would pay part of the price in cash and the other part by paying off the seller's debts to the company and the other partners.

After the conclusion of the transaction, the buyers had to make a capital contribution in the company to cover part of the debt originating from a relevant labour action that already existed at the time of the closing of the transaction. For this reason, the buyers filed a lawsuit for damages against the seller, requesting indemnification for the contribution made, alleging that they were unaware of the existence of the labour lawsuit.

The judge stressed that it was up to the buyers to check the existence of ongoing actions involving the company, in view of the duty of diligence inherent in corporate legal transactions. On the other hand, the judge highlighted that it was up to the seller to have informed the buyers about the existence of the action. The judge stated that there was concurrent fault between the parties and determined the reimbursement, by the seller, of 50% of the amounts contributed by the buyers in order to pay the liability arising from the labour lawsuit involving the company. In the decision, the Sao Paulo Court of Justice maintained the sentence and stressed that – and this is the important part – such ruling was due to the absence of an indemnity clause regulating and limiting the parties' liability.

In this case, the signing (ie, the execution of the shares purchase agreement) and the closing (ie, the implementation of the transaction, with payment of the cash price and transfer of the shares)(1) occurred in the same moment because the deal was not subject to condition precedents.(2) Therefore, according to usual provisions in M&A transactions, any liability arising from facts or acts prior to the execution of the deal should be beared by the sellers, although the Brazilian law provides that the buyer of shares assumes any liabilities relating to the company (if the agreement does not provide otherwise).

This case highlights the main objective of an indemnity clause, which is to keep away the statutory provisions which place on the buyer the burden of the company's liabilities and, then, regulate which party (ie, the buyer or the seller) will be responsible for losses incurred after the closing of the transaction (at which point the buyer will have already assumed ownership of the assets) arising from facts occurred prior to the closing of the transaction (when the assets still belonged to the seller).

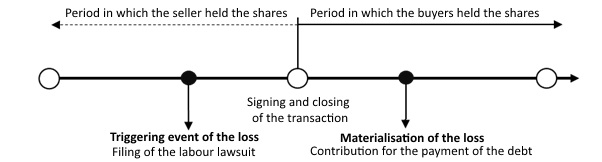

Figure 1 illustrates, chronologically, the occurrence of the triggering event (ie, the company's irregular labour practices that led to the filing of the labour lawsuit and the respective conviction) and the materialisation of the loss (ie, the contribution to the company to pay the labour debt).

Figure 1: Timeline of the occurrence of the triggering event and the materialisation of the loss

Notably, the filing of the labour lawsuit (and irregular practices that created the liability) occurred before the closing of the transaction (when the seller was still the owner of the shares), but the loss (ie, contribution to pay the debt) materialised after the closing of the transaction (when the buyers already owned the shares). In such cases, it is common for indemnity clauses to establish that the seller will indemnify the buyer, since the fact that generated the loss occurred when the seller owned the shares and was still subject to the business risks.

However, the absence of an indemnity clause expressly defining the parties' liability gave rise to a judicial dispute and the decision divided the burden of loss between the parties on the grounds of the existence of concurrent fault. This case illustrates the importance of:

- clearly establishing the indemnity provisions;

- avoiding conflicts;

- giving greater predictability to the parties; and

- preventing a business decision from being taken by the judiciary (or an arbitral chamber).

There is a wide variety of indemnity clauses, giving entrepreneurs ample scope to allocate risks as they prefer. Usually, the choice for one or another form of indemnity clause involves weighing the risks and benefits assumed by the parties: the more liabilities that have already been reflected in the negotiated price, the less protective the indemnity clause will be.(3)

The indemnity clause that generates the least protection for buyers is when the transaction is structured as a so-called 'closed gate', in which the buyer exempts the seller from all risks and responsibilities arising from past liabilities and contingencies, regardless of whether they have been disclosed, except for the indemnity for non-compliance with obligations assumed by the seller in the contract. On the other hand, the indemnity provision that generates the greatest protection for buyers is the complete indemnity clause, which provides that the seller will indemnify the buyer for losses that have triggering events prior to the closing of the transaction (as shown above), including the so-called 'sandbagging clause' in which the buyer's knowledge of a particular liability will not exempt the seller from indemnity payment in the event of materialisation of the liability.

If the contract of the case judged by the Sao Paulo Court of Justice had a 'closed gate' clause, buyers should fully bear the loss resulting from the labour lawsuit, even if it had triggering facts which had occurred prior to the transfer of shares to buyers. If the parties had used the full indemnity clause, the sellers would have had to indemnify the buyers, as the triggering event for the loss occurred when the shares were still owned by the seller.

In addition to these variations and others, there are limitations on the duty to indemnify that can be included in indemnity clauses. The most used limitations in M&A transactions are:

- the maximum amount cap, which establishes a maximum value for the obligation to indemnify;

- de minimis, which excludes individually irrelevant amounts from indemnity;

- the so-called 'basket', which determines the obligation to indemnify the accumulation of a certain minimum amount; and

- the time limitation, which limits the obligation to indemnify for a specified period after the closing of the transaction.(4)

Careful analysis of these mechanisms and limitations on the right to indemnity is critical to M&A transactions and plays a fundamental role in the allocation of risks between buyers and sellers.

Endnotes

(1) The contract provided for the signing of the amendment to the company's articles of incorporation, which would formalise the assignment of shares, after the signing of the contract, but the obligation to transfer the shares had already become payable at the time of signing the contract.

(2) The execution of the contract (signing) together with the closing of the transaction (closing) is common in less-complex transactions that are not subject to conditions precedent and, therefore, require no steps to be taken (eg, the approval of regulatory bodies) prior to the effective payment of the price and the transfer of assets.

(3) Adriano Augusto Teixeira Ferraz, Bernardo Vianna Freitas and Rodrigo Amaral Souza, "The allocation of risks in M&A operations: analysis of the price adjustment and indemnity clauses" in Henrique Barbosa and Sérgio Botrel (coord), New Themes of Law and Corporate Finance (Belo Horizonte: Quartier Latin, 2019).

(4) Adriano Augusto Teixeira Ferraz and Amanda Santos Sette Câmara Moreira, "Clauses limiting the obligation to indemnify in M&A transactions" in Bruno Mirada Gontijo, Fernanda Vale Versiani (coord), João Vitor O da Costa Cruz and Thomaz Murta e Penna (org), Corporate Law and Capital Markets (Belo Horizonte: Editora D'Plácido, 2018).