This article provides insight into the legal provisions of M&A agreements across the European Union in 2020 and identifies key market trends.(1) The article is based on a study which analysed private M&A agreements relating to both non-listed public and private companies in Europe between 2007 and 2020. Of the 5,017 transactions analysed, 408 relate to 2020 and 3,849 relate to the period between 2010 and 2019.

In analysing the 2020 market, this article reports on current market standards on risk allocation in M&A deals, comparing 2020 against 2019 and the previous 10-year average for 2010 to 2019. The data has been analysed against three different deal values:

- deals of up to €25 million;

- deals in a value range of €25 million to €100 million; and

- deals of more than €100 million.

The study covered 408 share and asset deals from 2020. Unsurprisingly for a year blighted by the COVID-19 pandemic, this volume represents a small decline in the number of deals covered in 2019. The pandemic led to delays and the renegotiation of key terms (including in certain cases in respect of transactions closed in prior years involving earn-outs) and, in some cases, transactions did not proceed. However, the disruption to the M&A market may not have been as severe as might have been anticipated in early April 2020.

The results of the study indicate a return to more 'buyer-friendly' positions on certain deal points. This may be a result of a more risk-averse environment prevailing due to the pandemic. For example, liability caps increased, limitation periods were longer and the application of de minimis and basket clauses flattened out. There were also fewer locked-box deals and, although earn-outs did not increase in use, earn-out periods were longer. It will be interesting to see whether all or any of these trends continue to apply in future years as the pandemic hopefully subsides.

The effect of the COVID-19 pandemic was felt primarily in the early part of the first lockdown when many deals went on hold, during which time parties analysed what impact the pandemic was having on target businesses. Although some transactions remained on hold or were terminated, many deals did come back and successfully close, albeit some with changed purchase prices or modification to key deal terms.

In many cases, the delay or failure in a transaction arose from caution from the relevant financiers. Where this did not apply, few transactions were terminated by reference to the application of a material adverse change (MAC) clause. In only a few cases did the threat of the application of such a MAC clause result in adjustments to the purchase price, the basis for payment or the renegotiation of earn-out provisions.

More 'buyer-friendly' provisions applied in 2020, likely in response to the COVID-19 pandemic. For example, the level of the liability caps applying to transactions increased significantly in 2020. There were fewer deals where the cap was less than 50% of the purchase price and there were many more deals where the liability cap was equal to the purchase price. However, nearly half of deals featuring warranty and indemnity (W&I) insurance still had caps of less than 10% of the purchase price.

Other signals of a more buyer-friendly environment include the fact that:

- the use of locked-box transactions declined slightly;

- de minimis and basket provisions flattened out so that they apply in just under three-quarters of the transactions covered;

- earn-out periods were longer; and

- limitation periods settled at approximately 18 to 24 months, although there was an increase in periods of more than 24 months.

Overall, the use of W&I insurance in EU transactions dropped off slightly in 2020 compared with 2019, although it remains relatively prevalent in larger transactions. This drop in use will likely not be a continuing medium to long-term trend as W&I insurance brokers report that enquiry levels at the end of 2020 were significantly high.

With regard to security for warranty claims, the decline in the use of escrow accounts and a corresponding increase in more straightforward price retentions has continued. This may be driven by a desire to avoid the cost and complexity of an escrow arrangement or may mark a change in market sentiment.

There was a modest increase in the use of legal technology tools, principally for document automation, but this still represents a minority of deals when adopted. Although it is likely that such use will continue to grow, there remains some way to go before it is of universal application.

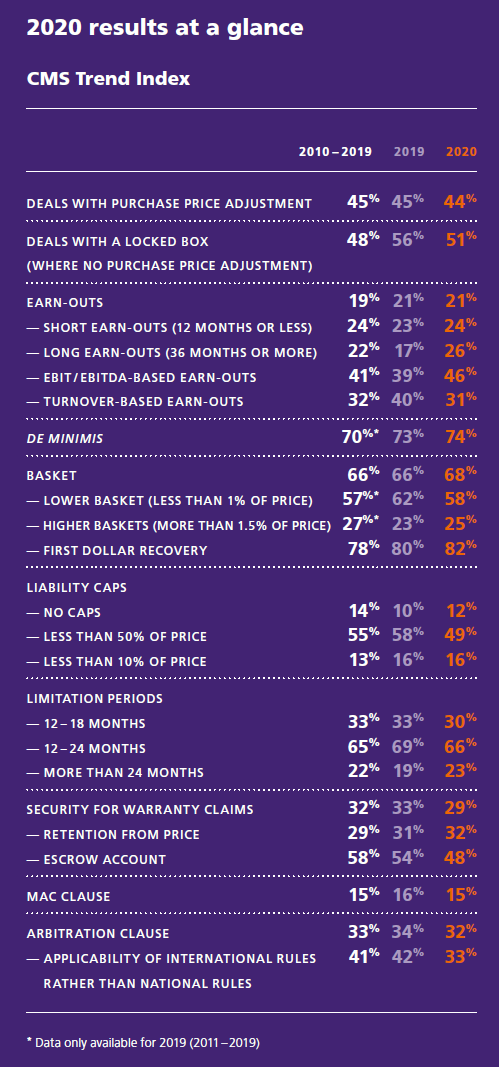

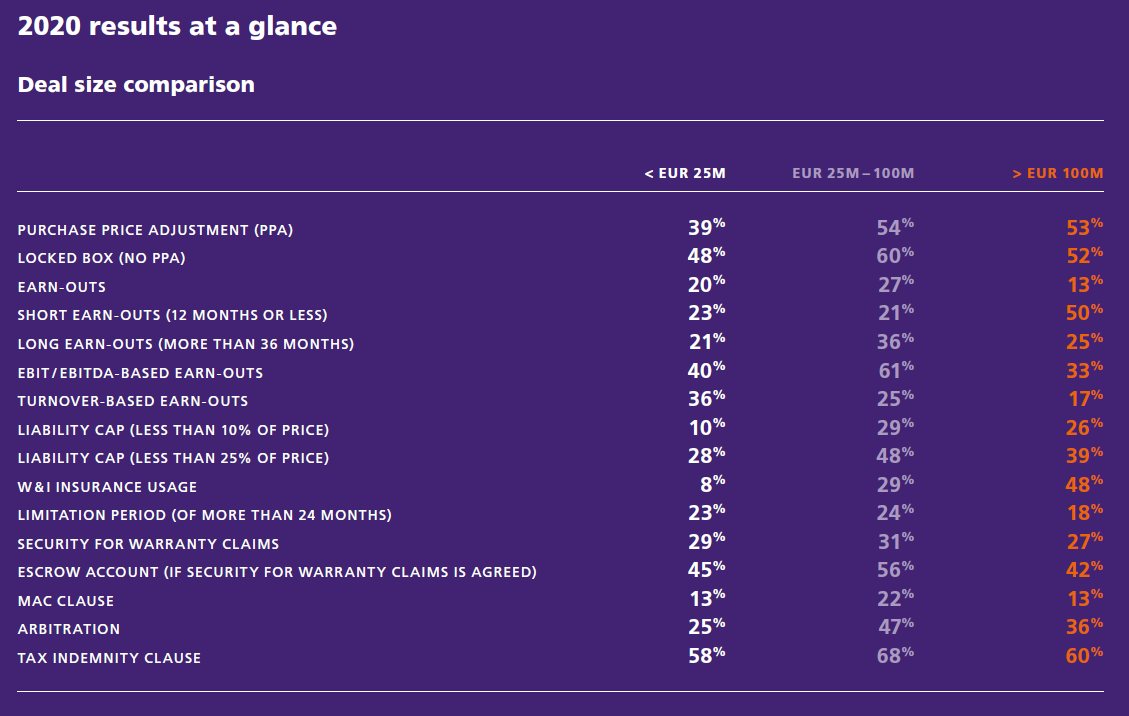

Figure 1 highlights the key findings of the study.

Figure 1

Purchase price adjustments

In 2020 there was a small decline in the use of purchase price adjustment (PPA) clauses in M&A agreements (44% compared with 45% for 2019). This seems to reflect a levelling-off in the application of such provisions over the past three years and reflects a decrease from the high of 49% in 2015. This may suggest that parties to M&A transactions are seeking more certainty as to the amount of the purchase price when signing the transaction documentation.

Locked box

As with PPA provisions, there was a slight decrease in the use of locked-box arrangements for non-PPA transactions (51% in 2020 compared with 56% in 2019). However, the overall upward trend for the application of a locked box continues, particularly when compared against the average usage of 48% for the period 2010 to 2019.

Earn-outs

With the impact of the COVID-19 pandemic, some increase in the use of earn-outs was anticipated; however, the statistics show overall that there was little change (in 21% of deals). The position in the European Union remains above the average level over the past decade but earn-outs remain less popular than in the United States. Perhaps 2021 will see the expected increase as deals originated and negotiated during the pandemic are transacted.

W&A insurance

The year-on-year rise in popularity of W&I insurance dropped off in 2020 by 2% (down to 17%). However, in almost half of the large transactions (€100 million and more) analysed, W&I insurance was used.

De minimis

There was a flattening of the number of EU transactions which include a de minimis clause at 74%, representing a continuation of the trend over the past three years. It also represents a slight increase to the percentage in 2019 at 73%. This demonstrates that a de minimis is the predominant market norm across most EU jurisdictions.

Baskets

There was a slight increase in the application of baskets in EU transactions at 68% for 2020 compared with 66% for 2019, which broadly represents the average for the years since 2017. This level may reflect the use of W&I insurance, where the basket may not be as relevant if the equivalent liability is assumed by the W&I insurer. The correlation between the application of a basket and a de minimis provision continues to apply, although the recent trend is that a de minimis applies to a greater extent than a basket (returning to the more recent average of 74% compared with 68%).

Liability caps

In 2020 there were many deals with liability caps equal to the purchase price. There was also a large decrease in the number of deals with a liability cap of less than 50% of the purchase price, down to 49% from highs of 60% in 2017 and 58% in 2015, 2016, 2018 and 2019. However, the amounts of those caps are subject to significant variation depending on the deal size and, most significantly, whether W&I insurance cover applies to the transaction. For example, 51% of transactions with W&I insurance had caps of less than 10% of the purchase price as compared with just 10% of deals without W&I insurance.

Limitation periods

Buyers were able to achieve longer limitation periods in 2020, marking a shift to more buyer-friendly positions in this area. This is demonstrated by the growth in use of longer (24 months or more) limitation periods (23% of deals – up 4%) and a corresponding 4% reduction in the number of shorter periods (18 months or less). This seems to have been a development both generally and also significantly in medium and large-sized deals, where in previous years limitation periods had tended to be shorter.

Security for warranty claims

With more buyer-friendly deal terms elsewhere, it is perhaps surprising that there was a fall in the use of security in 2020 (down 4% to 29% of deals). While escrow accounts remained the most popular form of security, their popularity continued to fall in 2020 – down to 48% compared with 54% in 2019 and below the 10-year average of 2010 to 2019 (58%). There was a corresponding increase in simple retentions and holdbacks from the purchase price with parties perhaps preferring to avoid the complexity and cost of establishing an escrow account.

MAC clauses

Any anticipated increase in deals involving MAC clauses because of the pandemic did not occur as the percentage of deals involving a MAC fell 1% to 15%, a figure consistent with the previous 10-year average.

Arbitration

In 2020 arbitration was used as the dispute resolution mechanism in 32% of deals, marking a 2% decrease compared with 2019. However, this is generally consistent with its long-term popularity over the course of the previous 10 years (2010 to 2019), where the average was 34%. Arbitration was less popular in certain regions than others, albeit over the past decade the popularity of arbitration has remained relatively stable within each region.

Tax

Tax indemnities were agreed in 61% of deals in 2020. While this is slightly higher than the 10-year average (59%), it reflects a levelling-off in the application of such indemnifications over the past years and a slight decrease from the high of 64% in 2014.

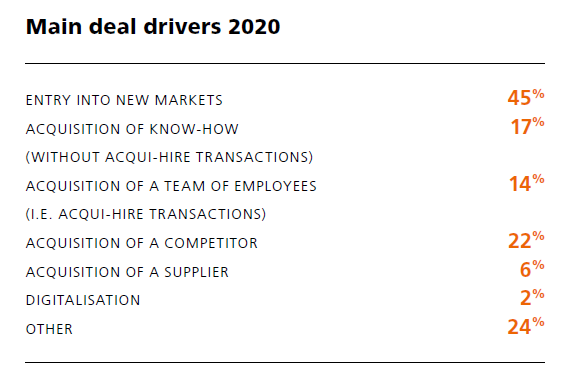

The study sought to identify the main deal drivers for each relevant transaction. There was a broadly consistent result to previous years, with most deals seeing a buyer wishing to enter a new market, which will often be the case for private equity-backed purchasers.

The details for 2020 were as follows (Figure 2):

- 45% of the deals covered represented the entry into a new market by the purchaser;

- 31% of all deals were either the acquisition of know-how or acqui-hire transactions; and

- 22% of the deals were the acquisition of a competitor.

The proportion of new entry and know-how or acqui-hire transactions appears to have levelled off, after having seen a significant increase from 2018 (32% and 23%, respectively). Notably, a consistent 24% of deals had other unknown drivers, again demonstrating the variety of underlying reasons for entering into M&A transactions.

Figure 2

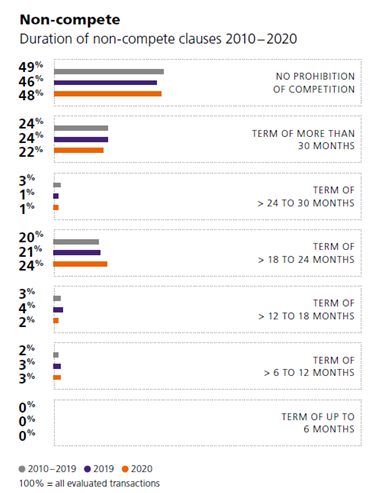

Non-compete clauses which restrict the post-completion activities of the seller seek to ensure that the buyer receives the full value inherent in the acquired business. In most EU jurisdictions, the period for which a non-compete can be legitimately enforced against a seller is limited by antitrust rules and public policy issues. This is demonstrated from the study's finding that the duration of non-compete clauses has remained static over the period with the most common restrictive periods being for either two years or for more than 30 months (Figure 3). There was a significant increase in the application of more than 30 months in various EU jurisdictions.

Figure 3

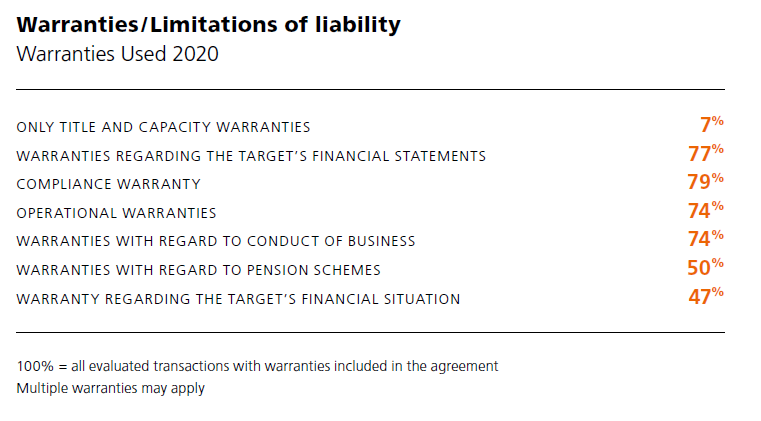

The study considered the nature of the warranty cover included in the transaction agreements. As with a previous study, it was found that warranties regarding the target's most recent financial statements, post-balance sheet conduct of business, compliance and operations are common and apply in approximately 75% or more of all agreements analysed. However, specific warranties about the target's profitability and its pensions position are much less usual (50%) and few agreements contain only title and capacity warranties (7%) (Figure 4).

Figure 4

The study divided deals into 'small', 'medium' and 'large' as below and highlighted differences in deal terms between them:

- deals with values of up to €25 million are small deals;

- deals with values of between €25 million and €100 million are medium-sized deals; and

- deals with values of more than €100 million are large deals.

Figure 5 shows the findings.

Figure 5

PPAs appear more frequently in large deals (53%) and medium-sized deals (54%) and the percentages for each have increased, while the use of PPAs in smaller deals dropped to 39%. This is consistent with the expectation that given the turbulence that the COVID-19 pandemic has caused in the economy, buyers will want greater ability to check that the correct price is being paid.

There has been a corresponding, and expected, drop in the popularity of locked-box structures for both large deals (85% to 52%) and medium-sized deals (less significantly to 60%), which is likely due to a lack of buyer confidence in locked-box balance sheets prepared as at a date prior to the period affected by the pandemic and thus a lack of confidence in balance sheets reflecting a true and fair view of the target's financial situation after the start of the pandemic.

Continuing the trend from prior years, earn-outs are rare in larger deals (only 13%). However, there was a pronounced change in the duration of those earn-outs in 2020: 75% of the earn-outs in large deals were of a period between six and 24 months and there was a corresponding fall in the number of longer earn-out periods (from 38% to 25%).

There has been a change in respect of earn-out metrics across all deal sizes with earnings before interest and taxes and earnings before interest, taxes, depreciation and amortisation returning to being the most popular criterion on which earn-outs were calculated, particularly in the medium-sized deals (61%).

While the study continues to point towards large and medium-sized deals having lower liability caps (in percentage terms), it is significant that in 2020 purchase price caps on large and medium-sized deals rose in their use (to 31%), perhaps reflecting a shift to a buyer's market on this most key financial limitation.

The popularity of W&I insurance appeared to level off in 2020 with the percentage levels across small, medium and large deals broadly equivalent to those seen in 2019. W&I insurance is still used frequently in large deals.

While time limitation periods to bring warranty claims tend to be shorter for larger transactions, the frequency of longer limitation periods (eg, more than 24 months) for medium and large deals in 2020 was significantly higher than the average over the past decade – again highlighting a switch to a more buyer-friendly market on this point.

Across all deals, the overall frequency of security constructs remained broadly the same in 2020; however, there were differences across deal sizes with the popularity of security dropping from 34% in both small (to 29%) and medium (to 31%) deals, while there was an increase in large deals (increasing to 27% from 24%). There was a significant fall in the use of escrow accounts in large deals (down to 42% of deals involving security from 63%).

Overall, the data indicates as follows:

- The modest growth in the use of PPAs, longer earn-out periods and drop in locked-box structures in larger deals suggests that the desire to fix the price at closing has been overtaken by the parties' wish for pricing structures which enable them to revisit the position after closing – a likely outcome of the pandemic.

- In terms of risk allocation, there also appears to have been a shift towards buyer-friendly terms in respect of liability caps, security and limitation periods in the more significant-sized transactions.

- With fewer deals overall and arguably more smaller deals in value terms in the market, there has been a levelling-off in the surge of W&I insurance, although its frequency of use remains broadly equivalent in terms of deal sizes to prior years (ie, significant usage on large deals).

The COVID-19 pandemic has led to delays and the renegotiation of key terms and, in some cases, transactions have not proceeded. However, the study remains cautiously positive about future deal activity in the European Union. The development and roll-out of numerous COVID-19 vaccines, a tentative return to international travel and life slowly returning to normal should encourage corporates and sponsors to hopefully look towards the future. The strength of the equity capital markets and private equity indicates that there should be an up-tick in transaction volumes.

The study indicated that more buyer-friendly provisions applied in certain areas. This may be as a result of a more risk-averse environment prevailing. For example, liability caps increased and limitation periods were longer. It will be interesting to see whether these trends continue to apply in future years.

The study also highlighted some new market trends:

- the application of W&I insurance in EU transactions dropped off slightly in 2020;

- there was an increase in deals where the liability cap was equal to the purchase price;

- the use of purchase price adjustment clauses and locked-box transactions declined;

- de minimis and basket provisions flattened out; and

- limitation periods have settled at around 18 to 24 months, although there was an increase in periods of greater than 24 months.

Endnotes

(1) This article is based on the CMS European M&A Study 2021, which is available here.