The Central Board of Direct Tax (CBDT) recently learned that start-ups have been receiving notices under Section 143(2)/147 of the Income Tax (IT) Act 1961 both before and after the Department for Promotion of Industry and Internal Trade (DPIIT) issued its notification regarding the applicability of Section 56(2)(viib) of the act.(1) Following the issuance of the DPIIT's notification, the CBDT issued a notification reiterating that provisions of Section 56(2)(viib) of the act concerning the issue of shares at a price greater than face value do not apply to shares in a start-up which fulfils the requisite conditions set out in the DPIIT's notification.(2)

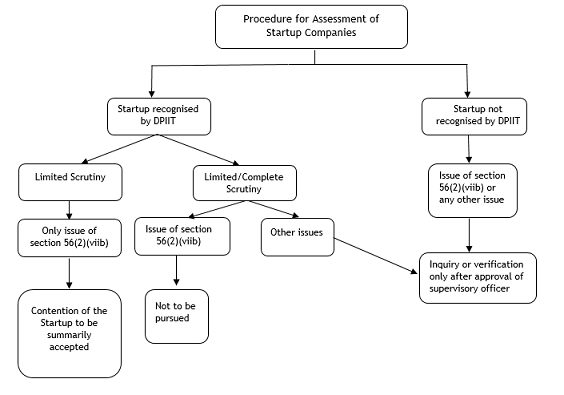

In order to clarify this matter, the CBDT has issued a circular(3) outlining the assessment procedure to be undertaken by the tax officers of start-ups with regard to Section 56(2)(viib) issues, which is as follows.

This CBDT circular has clarified the applicability of Section 56(2)(viib) of the IT Act and the procedure that must be followed by tax officers in assessment proceedings. Although an attempt has been made to end the confusion created in the start-up community, uncertainty surrounding the legal basis for the DPIIT and CBDT notifications remains.

Endnotes

(1) DPIIT Notification GSR 127(E), dated 19 February 2019.

(2) CBDT Notification 13/2019/F 370142/5/2018-TPL (Pt), dated 5 March 2019.

(3) CBDT Circular 16/2019, dated 7 August 2019.

This article was first published by the International Law Office, a premium online legal update service for major companies and law firms worldwide. Register for a free subscription.