While traditional initial public offerings (IPOs) have become risky, difficult and vulnerable to conflict as to the issuer's valuation, a merger or combination with an IPO-funded special purpose acquisition company (SPAC) offers an alternative. The recent popularity of SPACs can be linked to, among other things, their structure, which provides advantages and benefits for SPAC investors, SPAC sponsors and private companies that wish to raise public funds. Compared with an ordinary IPO, a SPAC provides the target with more certainty of closing at the expected value and allows the target to access public markets for liquidity and future fundraising activities.

This article highlights several Israeli tax considerations relating to SPACs.

A SPAC is a newly established company, with no commercial operations, which is formed by sponsors for the sole purpose of raising capital through an IPO and then combining with an operating private company (target) within a pre-defined timeframe. The combining of the IPO funds with the target's business is known as the 'de-SPAC phase'. SPACs are also known as 'blank check companies' since, at the time of investment, the investors do not know with which target the SPAC will combine. In the United States, SPACs have existed for many years but, recently, favourable market conditions have attracted leading sponsors, underwriters and investors and led to SPACs raising a record amount of IPO funds in 2019, 2020 and the first quarter of 2021.

A SPAC typically has between 18 and 24 months from the closing date of its IPO to complete a combination with a target. In that timeframe, the SPAC's sponsors must identify a target, which will ideally be consistent with the SPAC's investment objectives, and complete the merger. The SPAC's shareholders must approve the merger transaction. This approval is usually granted as the shareholders have the right to redeem their funds regardless of whether they support or object to the transaction; they also maintain warrants regardless of whether redemption is effected. If a SPAC fails to complete a successful merger within the designated timeframe, the IPO capital, raised from the public and held in trust, will be released to the investors, together with accrued interest. If the shareholders approve an acquisition, such funds (less redemptions, if any) will be released from the trust to the SPAC to be made available to the target. To compensate for redemptions and validate the merger terms negotiated by the sponsor, a concurrent private investment (commonly known as a 'PIPE' transaction) will usually take place as part of the de-SPAC phase.

Merging with a SPAC can be an attractive option for private companies that:

- need public liquidity and funds; and

- can substantiate credible and robust growth projections over a reasonable timeframe but cannot, or do not wish to, access the ordinary IPO market.

Merging with a SPAC also offers targets greater certainty as to valuation, as the SPAC structure enables them to raise public funds without being as affected by changes in broader market sentiment.

The increased interest in SPACs in Israel follows the trend seen in the United States. In particular, Israeli high-tech start-ups are considering SPAC combinations as a source of funding and liquidity as part of their growth and exit strategies.

Typical Israeli SPAC structure

SPACs are usually organised in an offshore jurisdiction or the United States, mostly depending on the target's tax residency and size. SPACs are generally listed on the New York Stock Exchange and NASDAQ.

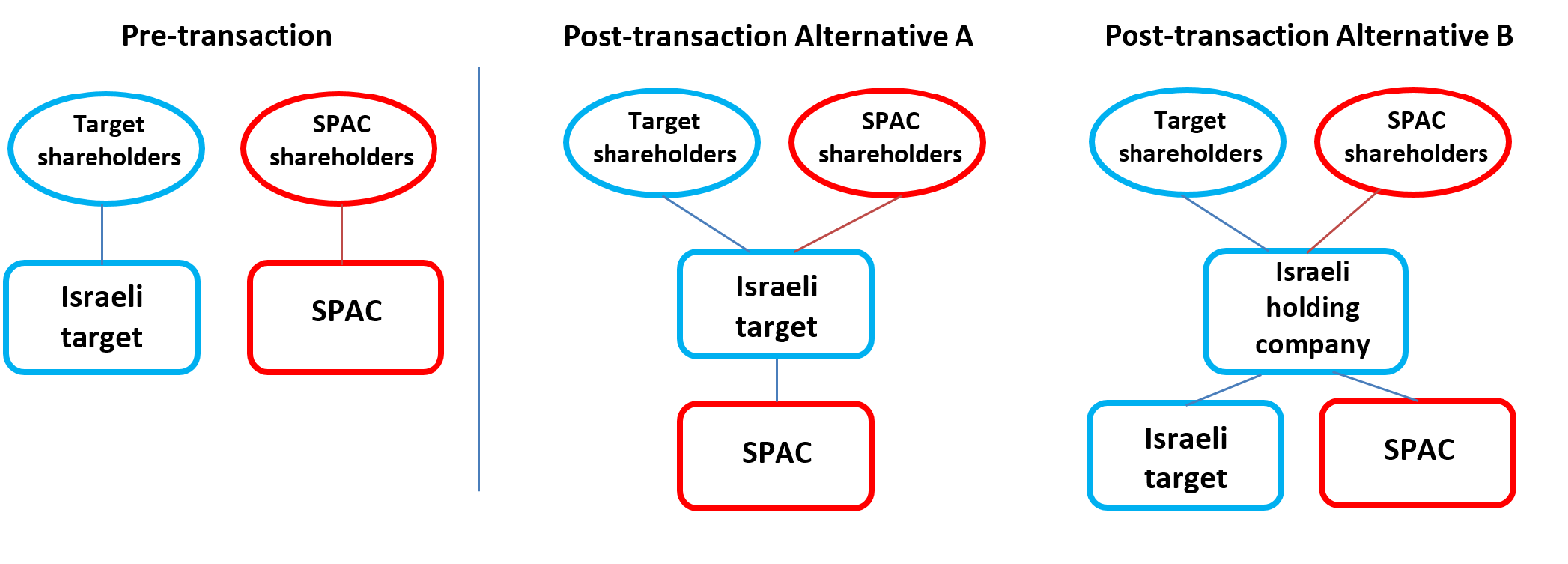

The most common structure for a SPAC transaction with a US target is a straight buy-out by the US-organised and listed SPAC of the target or a merger transaction in which the listed entity is either the SPAC or a newly formed holding company, usually with the same tax residency as the SPAC. However, the structure for SPAC transactions with an Israeli target usually requires modifications to accommodate Israeli tax aspects, such that the result is that the listed entity is the Israeli target or a newly formed Israeli holding company (typical Israeli structure).

The typical Israeli structure raises the following principal tax considerations:

- The Income Tax Ordinance (New Version) 1961 provides that a sale or exchange of shares is a taxable event, generally subject to capital gains tax.(1)

- Such a sale or exchange of shares may be exempt from tax if the transaction qualifies as a tax-free reorganisation under Part E2 of the ordinance.(2) Although the ordinance provides for a tax exemption for share exchange transactions, when the listed entity (TopCo) is non-Israeli, the Israel Tax Authority (ITA) tends to apply much more burdensome restrictions to avoid any erosion of Israeli tax basis.

- If the TopCo is non-Israeli, any upstream payments or distributions by the Israeli target to the non-Israeli TopCo may create complexities and potential tax leakage (eg, withholding taxes). If the TopCo is a US entity, the Israeli target may be classified as a controlled foreign company (CFC) for US federal income tax purposes and, as a result, the group's effective tax rate may be increased.

- Many Israeli targets are eligible for certain tax benefits under the Encouragement of Capital Investments Law (5719-1959), including a reduction of the corporate income tax rate to as low as 7.5% (instead of the default rate, which is currently 23%). If the Israeli target enjoys such tax benefits but is also classified as a CFC for US federal income tax purposes, the US TopCo may be required to complement any tax payments in the United States under the Global Intangible Low-Taxed Income tax regime.(3)

In view of the foregoing, the Israeli market has adopted a different default preference than that usually used in the United States for the target purchase technique. The following diagrams represent the two most common structures in Israel.

Alternative A is the most straightforward structure used for a SPAC combination with an Israeli target. The structure is created by a simple exchange transaction in which the shareholders of the SPAC exchange their shares for shares in the target. The SPAC becomes a private subsidiary of the target and the target becomes the listed parent by registering its post-merger securities under a Form F-4 filed in connection with the merger approval process. Following the transaction, the SPAC may distribute the funds that it raised to the Israeli target. The main advantage of this structure is that there is no disposition of the shares in the target and therefore no taxable event occurs with respect to the target's shareholders.

Alternative A is the most straightforward structure used for a SPAC combination with an Israeli target. The structure is created by a simple exchange transaction in which the shareholders of the SPAC exchange their shares for shares in the target. The SPAC becomes a private subsidiary of the target and the target becomes the listed parent by registering its post-merger securities under a Form F-4 filed in connection with the merger approval process. Following the transaction, the SPAC may distribute the funds that it raised to the Israeli target. The main advantage of this structure is that there is no disposition of the shares in the target and therefore no taxable event occurs with respect to the target's shareholders.

Alternative B is created by multiple exchange transactions in which the shareholders of the SPAC and the target exchange their shares for shares in a newly incorporated Israeli holding company. Upon completion of the de-SPAC phase, the Israeli holding company is the listed entity. Alternative B results in a taxable event for the shareholders of the Israeli target upon the contribution of the shares of the Israeli target to the Israeli holding company. The Israeli target shareholders may seek a pre-ruling which confirms a tax-free reorganisation pursuant to the ordinance (described in greater detail below). Such a pre-ruling is relatively straightforward and easy to obtain. Following the transaction, the SPAC may distribute the funds that it raised to the Israeli holding company, which will then reinvest such funds in the target.

Under each of the alternatives, to the extent that there are Israeli shareholders in the SPAC, the exchange of the SPAC's shares in consideration for the Israeli target or the Israeli holding shares will result in a taxable event in Israel for such Israelis. As discussed, it may be possible to structure a tax-free reorganisation pursuant to the ordinance to defer the tax of the SPAC shareholders, which the ITA should confirm in a pre-ruling.

The main forms of tax-free reorganisation under Chapter E2 of the ordinance that may be relevant for such SPAC combination transactions are:

- a merger by exchange of shares pursuant to Section 103T of the ordinance; and

- an exchange of publicly traded shares pursuant to Section 104H of the ordinance (which allows a tax deferral for a period of 24 to 48 months).

As mentioned above, if the typical Israeli structure is implemented, the merger transaction could be executed with minimal or no involvement by the ITA.

The principal Israeli tax considerations relating to SPACs are as follows.

Flattening capital structure of target or SPAC

A company seeking to be listed on a stock exchange typically needs to have a single class of ordinary shares. Thus, in order for an Israeli target to be listed, its different classes of share must be converted into a single class of ordinary shares. Such a conversion may, under certain circumstances, lead to a taxable event in Israel. Although the ITA has not issued specific guidance on this matter, the market practice is that if the conversion is a standard one-to-one conversion to ordinary shares and is made in accordance with the target's articles of association, no tax event results. However, if the conversion is not in accordance with the target's articles of association or certain shareholders receive additional rights as a result of such conversion, the ITA may view it as a taxable event.

Post de-SPAC cash distribution from SPAC to target

If the typical Israeli structure is implemented, a question arises as to the Israeli tax ramifications of the upstream cash distribution by the SPAC, bearing in mind that a dividend received by an Israeli corporation from a non-Israeli entity will be taxed at the corporate tax rate, which is currently 23%. On 31 December 2020 the ITA published Tax Ruling 3312/20, which deals with this issue. According to the ITA, an upstream distribution of funds from a SPAC to its Israeli parent will be taxed as a dividend distribution only to the extent of the Israeli target's accumulated profits. Otherwise, the upstream distribution will be taxed as a capital reduction and the tax basis of the target in the SPAC shares will be deemed to equal the funds raised by the SPAC in the market.

Tax treatment of SPAC sponsors

A SPAC is usually led by an experienced management team with prior private equity, M&A and operating experience. SPAC sponsors typically receive between 10% and 20% of the equity in the vehicle at the time of the IPO. Sponsors are also typically issued founder warrants to acquire additional shares.

Sponsors usually receive no salaries, cash finder's fees or other cash compensation and the management team does not participate in a liquidating distribution if the SPAC fails to consummate a successful target purchase.

The main tax issue arising in regard to sponsors is whether their stake in a SPAC should be treated as if received in return for services or whether sponsors should be treated in the same manner as entrepreneurs of a start-up. On the one hand, sponsors establish SPACs and pay for founder shares, which should be viewed as an investment. On the other hand, the value of these shares can grow exponentially based on the sponsors' performance, which is more similar to compensation for services.

The impact of classifying sponsor equity as compensatory rather than as a capital asset is significant. While capital gains are currently taxed in Israel at 25% to 30%, income from work or services is subject to the marginal tax rates (currently up to 50%) plus social security and health insurance (currently up to 12.5%). Further, value added tax (currently at 17%) generally applies if the income is classified as income from services.

As the ITA has not expressed its opinion on this matter, the question of proper classification remains unanswered. Nonetheless, the timing of the issuance of the shares and warrants and the pricing thereof should be considered when planning.

Endnotes

(1) A sale of shares in an Israeli company by a non-Israeli resident is generally tax exempt, pursuant to the ordinance.

(2) A sale or exchange of shares in an Israeli company by a non-Israeli resident is generally tax exempt, pursuant to the ordinance; however, certain conditions must be met in order to qualify for such an exemption.