One of the welcome measures of the Swiss corporate law reform is the so-called 'capital band', which provides companies with more flexibility regarding changes to their capital structure. According to this new concept, a company's shareholders' meeting may authorise the board of directors to increase or reduce its share capital within a range of plus 50% and minus 50% of the current registered share capital over a period of up to five years. The capital band replaces the previous authorised capital, which allowed for only limited capital increases over a period of two years.

Since Swiss-listed companies could have used the capital band in an abusive manner to generate tax advantages for certain types of shareholder, the respective tax legislation had to be adapted. This article provides an overview of the relevant tax principles relating to the increase and reduction of share capital, as well as the changes required as a result of the introduction of the capital band.

The new law is expected to come into force on 1 January 2022.

Taxation of reductions in and increases of share capital

Capital reductions

If a Swiss company buys back own shares for the purpose of a capital reduction, the difference between the purchase price and the nominal value of the shares is subject to Swiss withholding tax at a rate of 35% and generates taxable income for Swiss-resident shareholders, as such share buyback is treated as a partial liquidation for tax purposes. In contrast, the share buyback is not subject to Swiss withholding tax and does not trigger any income tax implications for Swiss-resident individuals holding their shares as private assets if the shares are bought back against reserves from capital contributions.

In general, it is at a company's discretion whether it makes distributions of dividends or liquidation proceeds from capital contribution reserves or other distributable reserves. The same holds true for share buybacks. However, as of 1 January 2020, restrictions apply to Swiss-listed companies in the sense that they may pay out withholding tax-free dividends from their capital contribution reserves only if they simultaneously pay out a dividend in the same amount from their taxable distributable reserves (the so-called '50/50 rule'). The same 50/50 rule applies to buybacks of own shares by Swiss-listed companies aimed at a capital reduction.

In practice, Swiss-listed companies often establish a second trading line for the purpose of a subsequent capital reduction. However, for Swiss-resident individuals holding the shares as private assets, it is not beneficial to sell the shares on the second trading line since, in such a case, the difference between the repurchase price and the nominal value of the shares is taxable income (unless the shares are (partly) bought back against capital contribution reserves), whereas such a person may realise a tax-free capital gain if the shares are sold on the ordinary trading line. The second trading line is also unattractive to non-Swiss shareholders who may be entitled to a full or partial refund of Swiss withholding tax of 35% only if the country in which they reside for tax purposes has concluded a double tax treaty with Switzerland and further conditions of such a treaty are met.

Hence, in practice, only Swiss corporate shareholders, which are entitled to a full refund of Swiss withholding tax and to which the book value principle applies, typically participate in a share buyback programme in a second trading line. However, as of 1 January 2020, Swiss-listed companies are required by law to offset at least half of the liquidation surplus against reserves from capital contributions, if any. This requirement limits the tax benefits and arbitrage opportunities relating to share buybacks on a second trading line to some extent. Due to the book value principle, Swiss corporate shareholders realise taxable income only on the margin resulting from the acquisition of shares on the ordinary trading line and the sale of shares in the second trading line. This margin may be virtually tax free due to the participation relief if the value of such shares amounts to at least Sfr1 million.

Capital increases

The issuance of new shares by and capital contributions to a Swiss-resident company are subject to a one-time capital duty at a rate of 1% (issuances of up to Sfr1 million are exempt therefrom).

New tax rules required for capital band

The interaction of the aforementioned second trading line and the newly possible capital band would allow Swiss-listed companies to generate tax advantages for their shareholders by buying own shares for the purpose of capital reductions on the second trading line from Swiss corporate shareholders and creating tax-free repayable reserves from capital contributions every time that a capital increase is made. As a result, taxable reserves could factually be transformed into tax-free repayable capital contribution reserves.

In order to prevent such a misuse of the capital band, new tax provisions will be introduced, stating that tax-free repayable reserves from capital contributions can be created only to the extent that the capital increases exceed the capital reductions at the end of the duration of the capital band (the so-called 'net view').

The same applies to the one-time capital duty of 1%, which is levied only after the expiration of the capital band period.

Numerical illustration

Non-listed Swiss company

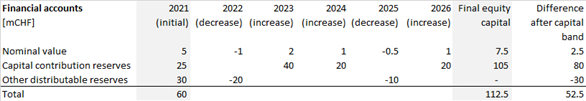

The following table shows how the capital band works, using the example of a non-listed company.

By applying the net view, the Swiss Federal Tax Administration (SFTA) would approve the newly created capital contribution reserves in the amount of Sfr50 million (total capital contributions of Sfr80 million minus the reduction of other distributable reserves of Sfr30 million) only after the end of financial year 2026, leading to a total amount of tax-free repayable capital contribution reserves of Sfr75 million. At the same time, the capital reductions in the years 2022 and 2025 would qualify as a taxable partial liquidation subject to withholding tax.

In addition, the 1% one-time capital duty would be levied on Sfr52.5 million (net increase of equity) upon expiration of the term of the capital band.

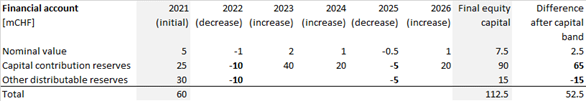

Swiss-listed company Although the draft bill and legislative materials contain no explicit explanation on the interaction of the capital band with the 50/50 rule, it can be expected that a Swiss-listed company will be obliged to offset the capital reduction equally against the capital contribution reserves and the other distributable reserves also under the framework of the capital band, which can be illustrated as follows.

By offsetting the capital contributions of Sfr80 million against the repayments of other distributable reserves of Sfr15 million at the end of the duration of the capital band, the SFTA could approve an additional amount of Sfr65 million as tax-free repayable capital contribution reserves. Taking into account the initial balance and the repayments of capital contribution reserves of Sfr15 million under the 50/50 rule, the closing balance of the capital contribution reserves would amount to Sfr75 million at the end of the duration of the capital band (rather than Sfr90 million as stated in the accounts).

In addition, the 1% one-time capital duty would be levied on Sfr52.5m (net increase of equity) upon expiration of the term of the capital band.

The capital band is a welcome and innovative new measure implemented in the Swiss corporate law reform which provides companies with more flexibility regarding changes to their capital structure. Thanks to an appropriate adaption of the Swiss tax rules, this new capitalisation tool could be widely used by Swiss companies. From a tax perspective, a net view applies and an increase in equity for the purpose of the one-time capital duty as well as the amount of tax-free repayable capital contribution reserves is determined only after the expiration of the term of the capital band. All Swiss companies which are considering introducing a capital band should carefully plan ahead and take into account the tax implications of the changes to the capital structure during the term of the capital band.