The Spanish government has published Royal Decree-Law 8/2020 of 17 March 2020 on urgent and extraordinary measures to address the economic and social impact of COVID-19 which supplements the labour-based measures adopted to date. This latest decree-law was set to enter into force on 18 March 2020 and will remain in place for one month. Following an analysis of the circumstances at such time, the government may pass a further decree-law to extend the term of the extraordinary measures.

The exceptional measures contained in the decree-law, which this article analyses in detail below, include:

- clarification of the grounds and simplification of the procedures to suspend employment contracts or reduce working hours due to force majeure, as well as economic, technical, organisational or production grounds;

- unemployment benefits for employees affected by contract suspension or working time reduction procedures, even if they have not observed the minimum contribution period requested;

- extraordinary benefits for self-employed workers forced to cease their activities;

- risk prevention and self-evaluation by employees to facilitate remote working; and

- expediting applications to adapt or reduce working hours to care for dependants.

Royal Decree-Law 8/2020 links the extraordinary measures listed above to companies' commitment to maintain workforce levels for six months from when that activity resumes; hence, the restructuring measures which companies wish to implement in the future must be closely watched.

In addition to these new measures, the government also published Royal Decree 465/2020 of 17 March 2020 amending Royal Decree 463/2020 of 14 March 2020, declaring a state of emergency to manage the health-related crisis triggered by COVID-19.

This latest regulation seeks to clarify the idea that persons found outside of their home performing permitted activities must be alone unless they are accompanying those with a disability, minors, the elderly or for any other just cause. Moreover, the temporary closure of hair dressing salons – not including home-based appointments – and the opening of veterinary clinics has also been confirmed.

Suspension of employment contracts and working time reductions

Procedures for suspension of contracts and reduction of hours due to force majeure

The suspension of employment contracts and reduction of working hours are deemed to be underpinned by an event of force majeure when they are directly triggered by a fall in activity due to COVID-19, including the announcement of a state of emergency, entailing:

- the suspension or ceasing of activities;

- the temporary closure of establishments frequented by the public;

- restrictions on public transport;

- restrictions on the movement of people or goods;

- a shortage of supplies which severely hinder the ordinary course of business; and

- preventative isolation measures ordered by the health authorities or, in urgent and extraordinary circumstances, due to contagion of the workforce.

All of the above situations must be duly evidenced in order to be considered force majeure events.

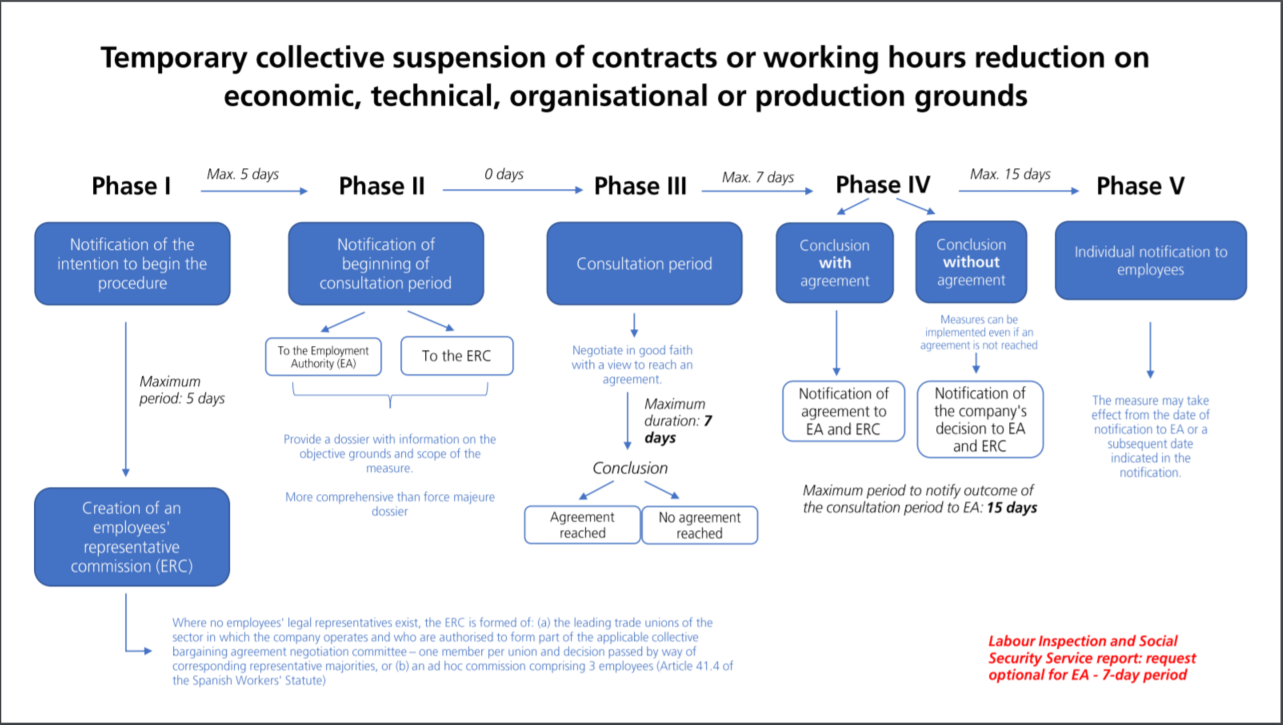

Figure 1 provides a timeline of the procedure for the suspension of contracts and reduction of hours due to force majeure.

Figure 1

The procedures for the temporary suspension of contracts or reduction of working hours due to force majeure have been amended as follows:

- Procedures will be initiated by companies, which must provide the relevant employment authority with a report on the link between the suspension of contracts or working time reduction and the fall in activity. This report must be supported by corresponding evidence.

- The company must notify their employees of the request and provide the employees' representatives (where existing) with the aforementioned report and any supporting documents.

- The Labour Inspection may issue a report within a non-extendable five-day period. Requests for the report will be optional for the employment authority, as opposed to its compulsory nature under the applicable legislation in relation to the rest of the force majeure procedures that are not linked to COVID-19.

- The employment authority will deliver its final decision within five days, which will be limited to verifying the existence of the alleged force majeure event, enabling the company responsible for the decision to apply the contract suspension or working hours reduction measure, which will take effect from the date of the force majeure event.

Procedures for suspension of contracts and reduction of working hours on economic, technical, organisational and production grounds

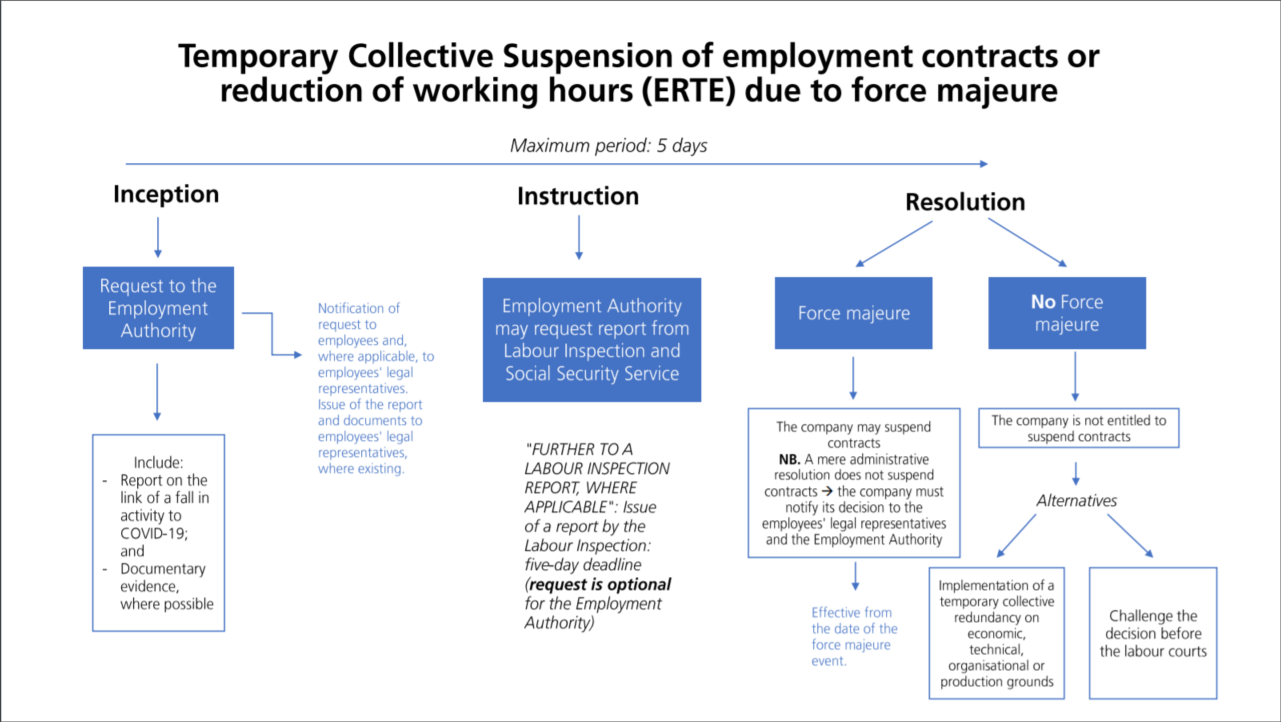

In cases involving the suspension of contracts and reduction of working hours on economic, technical, organisational and production grounds due to COVID-19, the following features will be applied in relation to the procedure outlined in the corresponding regulation. Figure 2 provides a timeline of the procedure.

Figure 2

Creation of employees' representative commission

Where a company has no legal representation for employees, the commission will be formed of:

- the leading trade unions of the sector in which the company operates and which are authorised to form part of the applicable collective bargaining agreement negotiation committee, with one member per union; or

- where the above is not created, a representative commission formed of three company employees chosen in accordance with Article 41.4 of the Workers' Statute.

In either of the above cases, the representative commission must be formed within the non-extendable five-day period.

Consultation period

The consultation period with the employees' representatives or representative commission as described above must last no more than seven days.

Labour Inspection report

The request is optional for the employment authority, with the report to be issued within a non-extendable seven-day period.

Extraordinary unemployment protection and ceasing of activity measures

In cases involving the suspension of contracts and the reduction of working hours detailed above, the State Employment Service will:

- recognise the affected employees' entitlement to unemployment benefit, even if they fail to meet the minimum contributions to be eligible for such benefit; and

- not count the time during which unemployment benefit is received while the current extraordinary circumstances remain, in view of the maximum period permitted to receive such benefit.

The duration of the benefit will be extended until the end of the suspension or working hours reduction period in question.

The initiation, instruction and termination of the procedure recognising the right to unemployment benefit will coincide with the terms of the applicable legislation for cases of temporary contract suspensions and working time reductions based on economic, technical, organisational and production grounds.

While the extraordinary public health measures remain in place, the submission of requests to initially register for or resume unemployment benefit or subsidies filed outside of the legally-established time frames will not lead to a reduction of the term of the corresponding right to the benefit.

Unemployment subsidies or those for persons aged over 52 whose requests for extension or other mandatory documents are submitted after the deadline will also not be affected.

Extraordinary benefit for ceasing of self-employed activities

On an exceptional basis and limited to one month from the entry into force of Royal Decree 463/2020 declaring a state of emergency, or until the last day of the month in which the state of emergency is lifted, self-employed workers whose activity is suspended or whose turnover for the month prior to the benefit application drops by 75% against the average turnover for the preceding six months will be entitled to an extraordinary benefit for the ceasing of activity.

This benefit will apply only to self-employed workers who:

- were registered with the Social Security Service and up to date with the payment of contributions on the date that the state of emergency was declared; or

- satisfy the social security authority's request to pay any outstanding contributions within 30 days.

The benefit amount will be calculated as 70% of the applicable contribution base and the time during which it is received will be counted as a contribution period. Any timeframes for the receipt of benefits for the ceasing of activity to which the self-employed worker may be entitled in the future will not be reduced in light of the above.

Extraordinary contribution-based measures

In cases of contract suspension and the reduction of working hours approved by the relevant employment authorities due to force majeure, while the period of authorisation remains, the following companies will be exempt from paying a portion of their social security contributions as detailed below:

- Companies with less than 50 employees registered with the social security authority as of 29 February 2020 will be exempt from corporate contributions and those relating to joint quotas.

- Companies with 50 employees or more registered with the social security authority as of 29 February 2020 will be exempt from 75% of corporate contributions.

In order to apply the above exemptions, companies must submit the corresponding request, identifying the affected employees and the specific periods during which their contracts will be suspended or hours reduced.

These company exemptions will not affect employees, who for all intents and purposes will be considered as still paying contributions.

Exceptional measures to facilitate remote working

Alternative measures such as remote working are considered a priority over temporary business closure or a drop in activity. Thus, companies must organise themselves accordingly to enable such alternatives where technically and reasonably possible.

For the purpose of facilitating remote working on an exceptional basis, companies' obligation to carry out a risk assessment will be considered fulfilled by means of a self-assessment performed by employees.

Exceptional care-related circumstances

Employees who can prove a duty of care towards their spouse, civil partner or blood relatives up to the second degree will be entitled to adapt or reduce their working hours under exceptional circumstances relating to necessary actions to prevent the widespread transmission of COVID-19.

The following features are therefore established in relation to the grounds that trigger applications to adapt and reduce working hours, as well as the procedure to be followed.

Reasons justifying applications to adapt or reduce working hours

Exceptional circumstances will be deemed to exist when:

- an employee is required to be present to look after those identified in the preceding section who require personal and direct care due to age, illness or disability; and

- governmental measures order the closure of educational institutions or day-care centres or when those who usually care or assist people in need are absent.

The right to adapt or reduce working hours is an individual right afforded to each parent or carer and must be justified, reasonable and proportional to a company's circumstances, most notably in the event that several employees of the same enterprise choose to exercise this right.

Working time adaptation

The adaptation of working hours will be primarily set out by employees in terms of scope and arrangement, provided that the request is justified, reasonable and proportional based on the specific care-related duties to be carried out by the employee. Companies and employees will make their best efforts to reach an agreement.

Such adaptation may comprise a change in shifts or schedules, flexible working, split or single shifts, work centre relocation, a change of duties, a change in the way work is performed – including remote working – or any other means available in the company or which may be implemented on a reasonable and proportional basis, limited to the exceptional period during which COVID-19 remains.

Working hours reduction

The right to a special reduction in working hours under exceptional circumstances will be subject to Articles 37.6 and 37.7 of the Workers' Statute, with the following exceptions:

- Working-hour reductions must be notified to companies at least 24 hours prior to the requested measure becoming applicable.

- Such reductions may stretch to 100% of the working hours provided that it is justified, reasonable and proportional in view of a company's circumstances, without entailing any changes as regards the application of the rights and guarantees in cases of working-hour reductions for legal guardians.

- In cases of reductions for the direct care of a blood relative up to the second degree who, due to old age, an accident or illness is in a position of dependency, there is no requirement that the relative in need of care and attention must be unemployed or retired.

- If an employee has already exercised their right to reduced working hours to care for legal guardians, they may temporarily waive such right or will be entitled to amend its terms. The request must reflect the present specific care-related needs, presuming that it is justified, reasonable and proportional, unless proven otherwise.