How can Hong Kong and foreign insurers sell insurance to mainland China?

Despite the COVID-19 pandemic, many mainland residents find foreign insurance policies more attractive than those found on the mainland and continue to cross borders to access them.

For example, the Hong Kong Insurance Authority's recently released provisional statistics for the Hong Kong insurance industry for the first quarter of 2020 show that new office premiums in respect of policies issued to mainland visitors amounted to $5.4 billion in the first quarter of 2020.

Despite their popularity, when mainlanders purchase Hong Kong insurance products, there is a unique set of risks for all parties concerned. In 2016 the China Insurance Regulatory Commission (CIRC) (the predecessor of the China Banking and Insurance Regulatory Commission (CBIRC)) issued a risk reminder for mainland citizens regarding the purchase of insurance products in Hong Kong. Specifically, it warned mainland citizens that:

- policies issued by Hong Kong insurers are not protected by Chinese legislation;

- risks of changes to Chinese or other laws applicable to foreign exchange should not be ignored; and

- there is uncertainty with regard to investment-kind policy yields.

Moreover, the CIRC's warning included a notice for mainland insurance intermediaries. In 2016 a special campaign was launched to crack down on the illegal promotion of Hong Kong policies in mainland China. At least one mainland insurance intermediary has been penalised for illegally promoting or selling foreign insurance products on the mainland.(1)

Hong Kong insurers, for their part, face risks in navigating restrictions on China's insurance market access. They are for the most part eager to provide their services to prospective mainland clients in China's thriving insurance market. However, as with other foreign insurers, they cannot directly sell insurance products unless they have successfully established a joint venture or wholly foreign-owned enterprise (WFOE) insurer in mainland China.

Why is the Insurance Connect scheme significant for Hong Kong and foreign insurers?

Through the Greater Bay Area Insurance Connect (GBA IC) scheme, Shenzhen will become a unique foothold for Hong Kong insurers serving mainland clients. The GBA IC allows them to provide post-sale services to mainland policyholders thanks to unique insurance market access permissions granted specifically to Shenzhen. So far, what is known is that under the GBA IC, two service centres will be established in Shenzhen – plus one in another city (to be determined) – featuring "counters for Hong Kong insurers" (service counters). The Hong Kong Federation of Insurers, the industry body in Hong Kong, will take the lead in renting office space in each of these two cities. Hong Kong-based insurers will then be allowed to set up service counters in these service centres to serve policyholders living in the GBA. This will allow GBA policyholders to pay premiums for their policies and modify their personal details under their policies without entering Hong Kong.

Why is this significant? Shenzhen is increasingly sharing Hong Kong's role as a GBA financial hub. To understand how significant this step is, the context for this development must be understood.

Significance of Shenzhen

In 1980 Shenzhen became China's first special economic zone, giving it more financial autonomy than other Chinese cities.(2)

Shanghai's dominant status as China's financial hub has not lessened Shenzhen's own ambitions as a financial services centre. One month after Shanghai's stock exchange reopened, Shenzhen established its own in December 1990. To this day, Shenzhen's stock exchange remains the only exchange in mainland China besides Shanghai's. Since 2014, both have been connected with each other and Hong Kong through the Shenzhen/Shanghai-Hong Kong Stock Connect. More recently, in 2017 the Shenzhen Insurance Regulatory Commission (SIRC) announced that Shenzhen was being made into the "first pilot city for the development and innovation of insurance" (the SIRC announcement).(3)

In 2019 Shenzhen received additional consideration as a financial centre after being designated China's 'model city' through the Opinions of the Central Committee of the Communist Party of China on Supporting Shenzhen's Pioneering Zone for Building Socialism with Chinese Characteristics (the Shenzhen Opinions).(4) Under Paragraph 5 thereof, the Central Committee encouraged the city to promote interconnection and mutual recognition of financial products with Hong Kong and Macao's financial markets.

Aligned with the city's plans for financial reforms, a 2020 announcement shows that Shenzhen is now set to become a 'pilot city' for the development and innovation of the insurance sector in China. On 24 April 2020 the People's Bank of China, the CBIRC, the China Securities and Regulatory Commission and the State Administration of Foreign Exchange (SAFE) released the Opinions on Financial Support to the Construction of Guangdong-Hong Kong-Macao Greater Bay Area (the Financial Support Opinions).(5)

According to the Financial Support Opinions, Hong Kong and Macau insurers will be invited to conduct pilot operations in GBA cities, paving the way for the further opening up of China's insurance market. In addition, this will facilitate GBA insurance business for Hong Kong and Macau insurers and facilitate GBA financial consumers' access to Hong Kong and Macau insurance products.

Actioning these earlier goals, the GBA IC therefore represents a concrete step towards greater market access for Hong Kong insurers. It builds on the Financial Support Opinions, the Shenzhen Opinions and the SIRC announcement on becoming a pilot city for insurance innovation and development. It is also a feather in Shenzhen's cap; putting these previous goals into practice is an important confirmation of the city's direction and its promise as an insurance hub.

The new GBA insurance regime will not make market access much easier for Hong Kong capital. At present, it refers only to post-sale transactions. Nevertheless, the GBA IC and its integration with, among others, the policies mentioned in the Financial Support Opinions will certainly make the GBA more attractive as regards foreign capital.

How does Shenzhen compare with Beijing and Shanghai for establishing an insurance WFOE?

Market access

When compared with Beijing and Shanghai, Shenzhen's market access reforms are leading and offer the greatest potential for preferential treatment for foreign insurers. This section examines Beijing and Shanghai's market access reforms and compares them with Shenzhen's new foreign investment regime.

Beijing

Recent measures build on Beijing's role as China's financial management centre and make the city a more favourable site for investing foreign capital in the financial services and insurance sectors. For one, Beijing is the only city in the comprehensive pilot project for the extensive opening up of the professional services industry. In 2015 the State Council issued the Reply on Approving the Overall Plan for a Comprehensive Pilot Project in Further Opening Up of the Service Industry in Beijing Municipality, which allows Beijing to test a wide range of innovative opening-up policies. This reply set out the plans for the further opening up of Beijing's service industry, whereby the establishment of foreign-funded professional health and medical insurance institutions would be supported. Since then, the State Council has issued two replies – one in 2017 and one in 2019 (the 2019 Beijing Reply), with the latter putting forward a three-year plan for reform and encouraging professionals in finance to work in the city. These replies indicate the national government's continued support for expanding Beijing's role as a financial services centre.

Beijing has also been proactive in implementing more permissive rules on foreign ownership in the finance and insurance sectors. In June 2020 the Beijing Municipal Commerce Bureau published the Beijing Action Plan for New Opening-Up Measures, taking "further opening-up of the financial sector" as a "key task". As regards how to further open up the financial sector, the document clearly states that life insurers – together with securities, fund management and futures companies –can be fully owned by foreign capital, and foreign insurance institutions can establish health insurance and pension companies in Beijing. However, this latter item, permitting full foreign ownership of insurers and their provision of pension and life insurance policies, is the implementation of China's new foreign investment policy as of 1 April 2020 (for further details please see "China, GATS, Trump: do non-US insurers get a piece of the US-China trade deal?"). It is not a Beijing-specific policy pilot; rather this is expected to eventually be applied by all sub-national jurisdictions in China.

Beijing's airport districts are also set to become pilot areas for certain financial reform programmes. Use of airports to this end is mentioned explicitly in the 2019 Beijing Reply. For Daxing Airport Free Trade District (Beijing), a list for institutional innovations is now available. The list contains 81 measures which involve nearly all governmental institutions responsible for the reform of the district. There are several innovation measures marked as "strong implementability" in the list, among them encouraging foreign investment in the financial sector.

Shanghai

Historically, Shanghai has been a pilot zone for testing market access liberalisation for financial services. Shanghai was once the only city in which foreign insurers could operate (for further details please see "China, GATS, Trump: do non-US insurers get a piece of the US-China trade deal?").(6)

The past decade has been no exception. When the Shanghai Free-Trade Zone (FTZ) was founded in 2013, one of the opening-up measures included providing special market access for foreign-invested specialised health and medical insurance institutions (as a testament to this pilot's success, such market access has now been extended to cover most of China). Shortly thereafter in 2014, the CIRC issued two notices on supporting the development of the Shanghai FTZ, which included 11 measures in the insurance sector.(7) Shanghai was also the site for the WFOE insurance holding company in China, Allianz insurance, four years earlier than initially planned. Moreover, in August 2020 Tesla registered for its own insurance brokerage in Shanghai to support insurance policies for Tesla owners.

Within Shanghai, the city's Lingang area will be the site for important policies to encourage insurance investment going forward. Under the Lingang Measures, Shanghai will support foreign funds to set up holding or wholly owned life insurers (in addition to securities, fund management and futures companies), as well as form joint ventures. In 2020 new policies regarding Lingang New Area (Several Measures for Comprehensively Promoting the Financial Opening and Innovative Development of Lingang Special Area of China (Shanghai) Pilot Free Trade Zone) take this development a step further. Specifically, Paragraph 4 indicates additional support for market access for foreign insurers, with the government "[s]upporting the establishment of foreign-controlled or wholly foreign-owned personal insurance companies". Moreover, a February 2020 circular encouraged insurance asset management companies to set up specialised asset management subsidiaries in Shanghai (Paragraph 10) and opened the door to pilot the permitting of insurance funds to invest in gold, oil and other commodities on a trial basis in Shanghai. It also encouraged insurance institutions to invest in science and innovation investment funds in the Lingang area (Paragraph 1) (Yinfa [2020] 46).

Most recently, Shanghai has announced ambitious development plans for its Hongkou district, intending to replicate 'China's Wall Street' along the North Bund waterfront to drive economic growth in the aftermath of the COVID-19 pandemic (the Hongkou Plan). The development includes plans to attract 100 major companies, particularly in the finance sector, to the North Bund's Hongkou area. This follows an earlier March 2020 announcement that Shanghai authorities would strive to bring 40 new regional headquarters for multinationals into the city and further open up controlled sectors, including insurance, as part of its post-COVID-19 recovery plans.

Comparison with Shenzhen

Despite Beijing and Shanghai's support for reforming and opening up their financial services and insurance sectors, neither of these cities' commitments match the level of detail available in Shenzhen commitments. Nor do they appear to share the same promise as the GBA, and particularly Shenzhen, for insurers' current and future market access.

Many of the most promising elements in Shanghai's Lingang Measures and the Hongkou Plan remain non-specific. The provisions of Yinfa [2020] 46 are encouraging, especially for insurance institutions which plan on investing in commodities or science and innovation. However, they have yet to be put into action and more details are needed to properly weigh the effects of the measure. The same can be said for the other measures within the Hongkou Plan, which are even more general.

Beijing has similarly sent encouraging signals that it intends to pilot market access schemes that are beneficial to foreign insurers, but concrete policies have yet to be put into place. The role given to airport districts for financial reform, in particular, is one to watch.

Comparing the three cities, it can be seen that while each has sent strong signals in favour of piloting greater market access benefits for foreign insurers, Shenzhen leads the pack and may go the furthest distance in implementation. Through the GBA IC, the Shenzhen and GBA authorities are already implementing the Financial Support Opinions, the Shenzhen Opinions and the SIRC announcement policies to bring greater market access to foreign insurers, especially for insurers based in Hong Kong. Although Shanghai's expected Lingang pilots encouraging commodity, science and innovation investments by insurers may end up being more preferable to insurance institutions with a strong interest in these sectors, Shenzhen still offers the most insurance-specific measures. Thus, while the GBA IC is currently limited to post-sales services, placed in its proper context, it becomes clear that this is a greater priority for Shenzhen than for other cities and will be the first of many market access pilots.

Taxes

Shenzhen's tax environment appears to be the most favourable for foreign insurers which are considering establishing a headquarters in mainland China.

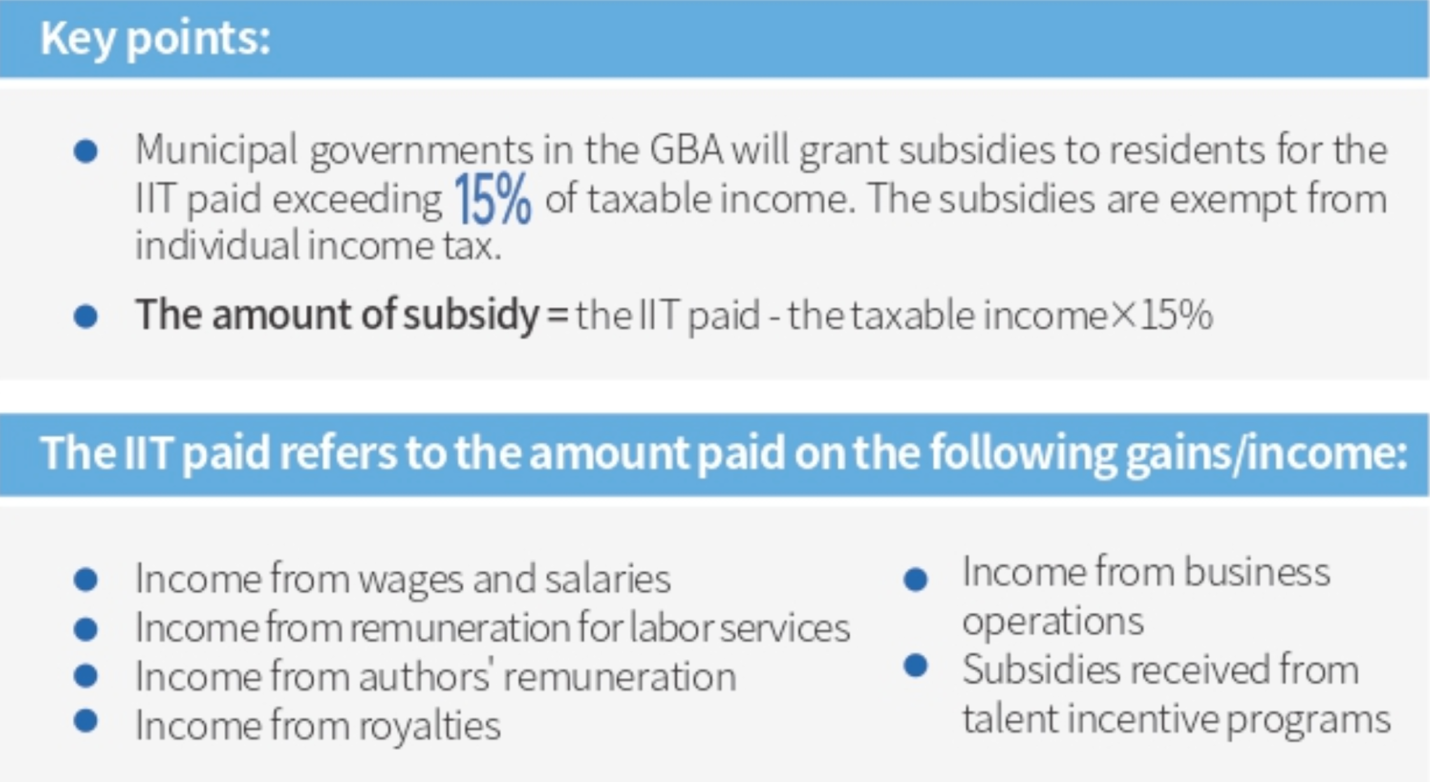

As a GBA city, Shenzhen benefits from Guangdong's preferential income tax policy for foreigners. The Ministry of Finance and the State Administration of Taxation issued Caishui [2019] 31 on 14 March 2019 (the 2019 GBA Circular). The 2019 GBA Circular allows foreign talents working in GBA cities such as Shenzhen to benefit from a tax rebate covering taxes in excess of 15% of their individual income tax (IIT). The 2019 GBA Circular expires on 31 December 2023.

Source: Department of Commerce of Guangdong Province, 2020 Invest Guangdong

Measures for the other two cities are positive but non-specific. In Shanghai, there have been some generally favourable announcements applicable within the Lingang area, but they remain general in nature. Specifically, under Number 6(9) of the Lingang Measures, overseas high-end and urgently needed talents working in Lingang will be allowed to benefit from certain IIT subsidies. A similar claim is made in the 2020 Shanghai Foreign Investment Guide (Page 59), which specifies that financial professionals are eligible for this subsidy, but otherwise provides no particulars. Beijing does not appear to have implemented or announced preferential IIT tax measures of this nature.

Shenzhen also benefits from Guangdong province's preferential foreign investment awards. On 21 August 2020 Guangdong issued the revised version of the Policies and Measures of Guangdong Province on Further Expanding Opening Up and Actively Attracting Foreign Direct Investment (10 Policies and Measures for Foreign Investment). One enumerated incentive is a one-time award of 30% of a foreign investor's financial contribution made when establishing a regional or national headquarters within Guangdong. Beijing and Shanghai offer no such award.

Administration

The financial costs for WFOE formation are similar across Shenzhen, Beijing and Shanghai, although local requirements and processing standards may lead to slightly faster service depending on the city.

Across Beijing, Shenzhen and Shanghai, some interactions with the State Administration for Market Regulation (SAMR) are moving online. In each of these cities, the application form for foreign-funded enterprises in China is being replaced by SAMR-administered online forms. For example, the Shanghai form (the 'one window, one form', available exclusively in Chinese) is available on the Shanghai government's website.(8) Similarly, Shenzhen has its own online portal,(9) as does Beijing. This 'one window, one form' policy is aligned with a broader push by the Chinese government to improve the country's business environment and reduce bureaucratic red tape.(10)

Once the greatest hurdle is cleared – namely, obtaining approval from the CBIRC – each city provides relatively similar processing times.

|

Statutory time limit (working day) |

Promised time limit (working day) |

|

|

Shanghai |

15 |

1 |

|

Shenzhen |

7 |

1 |

|

Beijing |

15 |

3 |

When establishing a WFOE, applicants must already possess an office address within the desired city at the time of application. Planning ahead on how to satisfy this administrative requirement will help to avoid costly delays in company formation.

Data

With regard to data management and control, insurers entering China must remember that the applicable laws are national. The Guidelines on the Information System Security Management of Insurance Companies (2011), together with the Cyber Security Law, apply with equal force in Beijing, Shanghai and Shenzhen.

As such, data management rules should not be a factor in how foreign insurers evaluate individual cities for their market-entry analysis.

For decades, Beijing, Shanghai and Shenzhen have attracted significant foreign investment in the financial and insurance sectors.

However, in light of Shenzhen's recent pilots and reforms, in particular the GBA IC, it is now the most favourable destination for foreign insurers which seek to establish a WFOE in mainland China. In terms of market access, foreign exchange controls and tax policies, the city has shown the greatest level of initiative and implemented the greatest number of preferential policies that benefit foreign insurers.

Nevertheless, this does not mean that insurers already based in Beijing and Shanghai should relocate to Shenzhen. Both Beijing and Shanghai have clearly demonstrated that they intend to pilot their own reforms in these areas. In addition, as China's model city, many pilots that succeed in Shenzhen are, eventually, well received elsewhere. Thus, the abovementioned competitive advantages in Shenzhen may, relative to cities such as Shanghai and Beijing, be temporary. That said, developing a dynamic and robust insurance sector is clearly a priority for Shenzhen, and its special support from both the state and provincial levels, combined with its proximity to well-established players in Hong Kong's insurance sector, allow it to act on that priority in promising ways.

Endnotes

(1) See Shanghai Banking Insurance Regulatory Insurance Punishment Juezi [2019] 36.

(2) See 1980 Guangdong Special Economic Zone Regulations.

(3) Shenzhen Insurance Regulatory Commission (2017) 14.

(4) 2019 Shenzhen Opinions.

(5) Yin Fa 2020, 95.

(6) See China's first Schedule of Commitments to the General Agreement on Trade in Services 1994.

(7) See Notice of the CIRC on Supporting the Development of the China (Shanghai) Pilot Free Trade Zone.

(8) Shanghai municipal government. Due to the presence of its free trade zone, Shanghai could pioneer online registration for companies doing business in areas not on the negative list before any other administrative area.

(9) Shenzhen municipal government.

(10) Dezan Shira & Associates, "Shanghai Business Registration: Online Platform for Foreign Invested Enterprises Launched", China Briefing, 22 August 2018.

Hannibal El-Mohtar, intern, assisted in the preparation of this article.