The Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac) announced on 5 February 2020 that they will stop accepting London Interbank Offered Rate (LIBOR)-indexed adjustable-rate mortgages (ARMs) by the end of 2020. Additionally, the two government sponsored agencies announced that they will soon accept mortgages tied to the Secured Overnight Financing Rate (SOFR) later in 2020. This announcement from Fannie Mae and Freddie Mac to move away from LIBOR and begin accepting SOFR ARMs is an important step in the market-wide transition to the Alternative Reference Rates Committee (ARRC)-recommended SOFR.

The ARRC, a working group established by the Federal Reserve Board of New York to help the transition away from LIBOR, has established a market consensus in favour of SOFR in the transition away from LIBOR. The ARRC is made up of members including Fannie Mae, Freddie Mac, lenders, investors, servicers and consumer advocates. In July 2019 the ARRC's Consumer Products Working Group released a white paper detailing the use of SOFR in constructing newly issued ARMs. In November 2019 Fannie Mae and Freddie Mac announced that the agencies would begin to incorporate ARRC-recommended fallback language for new US dollar close-end ARMs to replace LIBOR, in the event that it becomes unavailable, with SOFR.

On 5 February 2020 Fannie Mae announced that by the end of 2020, single-family and multifamily ARM loans indexed to LIBOR will no longer be accepted.(1)

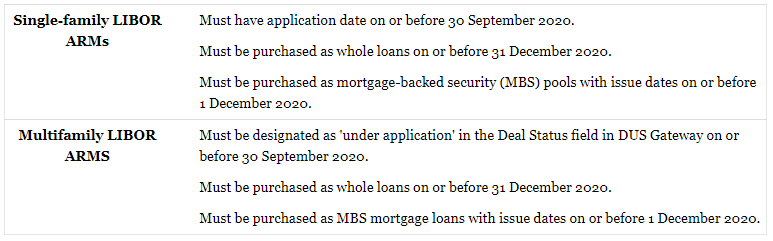

The following table outlines eligibility requirements for LIBOR-indexed loan delivery to Fannie Mae.

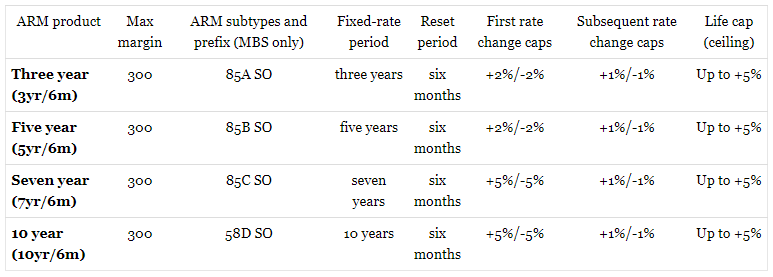

Fannie Mae anticipates that it will be able to accept whole loan and MBS delivery of SOFR-indexed ARMs during the second half of 2020. There will be several new ARM plans using an index based on a 30-day average of SOFR. Fannie Mae expects to release additional details about these plans in the coming months, including the application start date, changes to eligibility, underwriting and pricing, new ARM notes and riders that must be used, effects on desktop underwriter and loan delivery and committing and delivery requirements such as timing.

The following table describes the features of the new single-family ARMs based on the 30-day average of SOFR.

Fannie Mae expects to accept delivery of multifamily SOFR-capped ARM loans or MBS mortgage loans by the fourth quarter of 2020 at the latest. The SOFR-capped ARM loans are expected to use an index based on 30-day average SOFR, published by the Federal Reserve Bank of New York. Fannie Mae will provide further information relating to multifamily SOFR ARM prefixes and subtypes, along with confirmation of the 30-day SOFR index in the coming months.

In a bulletin issued on 5 February 2020, Freddie Mac announced that it will no longer purchase any LIBOR-indexed ARM with an application-received date on and after 1 October 2020.(2) Additionally, the agency announced that it will not purchase LIBOR-indexed ARMs on or after 1 January 2021, regardless of the application-received date or note date.

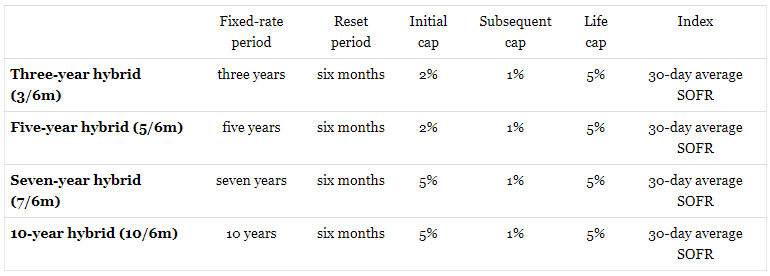

Freddie Mac will also begin purchasing ARMs that use an index based on SOFR by 1 November 2020 at the latest.

The following table describes the single-family hybrid ARMs based on a 30-day average SOFR.

Freddie Mac announced that it will be issuing future guidance on SOFR ARMs. This guidance will include the specific SOFR index or indices to be used for eligible SOFR ARM notes, eligibility, underwriting and pricing requirements, updates to loan selling adviser requirements and new ARM notes and riders specific to SOFR ARMs.

Endnotes

(1) Lender Letter LL-2020-01, Fannie Mae, 5 February 2020, available here; Single Family and Multifamily ARM Index Update, Fannie Mae, 5 February 2020, available here.

(2) Bulletin 2020-01, Freddie Mac, 5 February 2020. Available here.