India, like most countries, is coming to grips with novel coronavirus 2019 (COVID-19). The country is now under official lockdown, and the next few weeks will be critical in determining whether it has been able to successfully contain the virus.(1)

The COVID-19 outbreak is a stark reminder of the vulnerability of human life, and the downtime created by the social distancing rules presents individuals with a unique opportunity to consider their estate plans and discuss them with their families. All individuals, not just the elderly or ill, should take the time to implement an estate plan as it will make life simpler for remaining family members if the proper steps are taken now.

The first step to consider is writing a will. This is the simplest and most basic level of planning for anyone, regardless of their net worth or age. Procrastination and the unwillingness to accept death as part of life are common reasons for not having a will. However, if someone were to die from COVID-19, their family should be financially secure. A will can make that happen.

A will is a legal document that:

- outlines what happens with an individual's estate;

- sets out guardianship arrangements for minor children (if applicable); and

- helps to mitigate future disputes or legal challenges between family members.

Without a valid will, an individual's estate will devolve as per the laws of intestacy, which can often have an undesirable outcome.

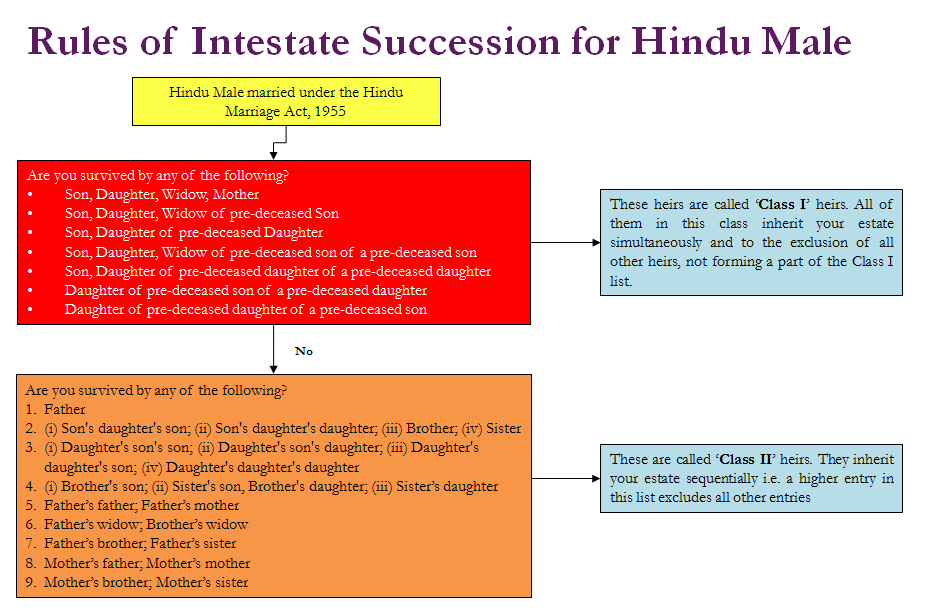

To illustrate some of the complexities involved in intestate succession, Figure 1 sets out the rules which apply to Hindu males, as per the Hindu Succession Act 1956 (which applies to intestacy in Hindus, Buddhists, Jains and Sikhs).

Figure 1

Under Section 8 of the Hindu Succession Act, the property of a male dying intestate will devolve on his legal heirs as classified in Schedule I of the Hindu Succession Act in a pre-determined proportion (Sections 10 and 11). Class I legal heirs inherit the estate simultaneously, to the exclusion of all other heirs, whereas Class II heirs inherit the estate sequentially.

Accordingly, if an individual intends to bequeath a particular asset from their estate to, for example, a specific family member, friend or charity, they must do so clearly in their will as the above default provisions are undesirable.

Executing a proper and valid will allows individuals to control how their estate is handled. It is possible to draft a simple will alone, but it is always better to speak (remotely, given social distancing) to an attorney. While trying to save costs, any mistake in a self-made will could jeopardise the entire estate plan. Care must be taken to clearly identify legatees (with personal identification details) and the assets being bequeathed.

Making a will is straightforward. It need not be on legal or stamp paper – plain paper is all that is needed. After writing the will by hand or printing it out, the testator must sign it in the presence of two independent witnesses. After that, the will is valid. Some individuals choose to register their will with the registrar; however, wills are not compulsorily registerable documents under Section 17 of the Registration Act 1908. Non-registration of a will will not affect its genuineness. (An attorney can provide further information on the circumstances in which registration should be considered.)

A will must nominate an executor, who will have the duty of carrying out the testator's wishes as per the will and the legal power to administer the estate. Careful consideration is required when appointing an executor, and it is recommended that the person be consulted before the will is made. Individuals often choose their spouse or eldest child, but every family and situation is different.(2)

If an individual's estate and family needs are basic, direct bequests to individual legatees (ie, a spouse, children, personal staff, friends or charitable organisations) may be preferable. However, if certain assets (eg, a shareholding in a family business, a family home or real estate investments) need to be handled more carefully (eg, because other family members are involved), it may be worth transferring them to a private trust – either during the testator's lifetime (which avoids the hassle of a probate or contested will) or via a testamentary trust, which comes into existence on the testator's death. Such decisions will require input from an attorney.(3)

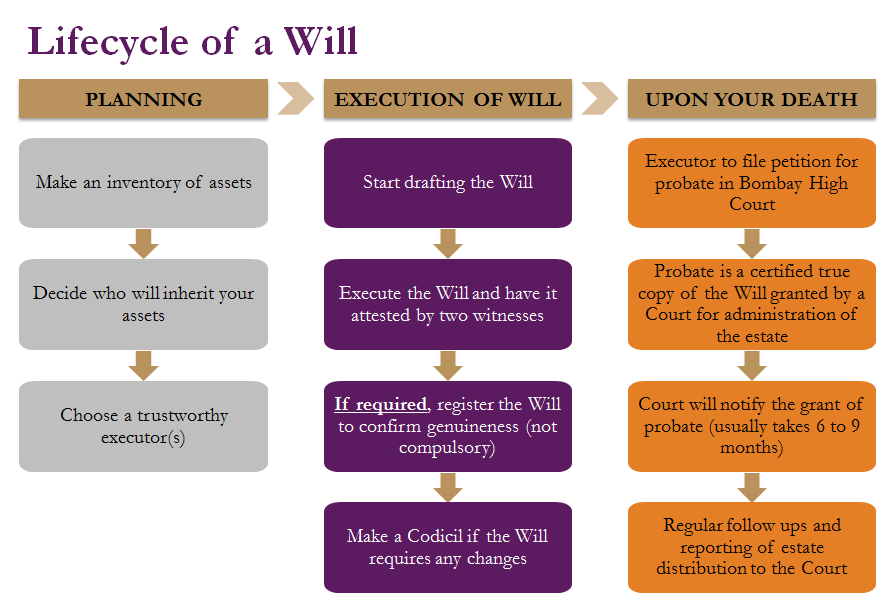

Figure 2 shows the typical lifecycle of a will signed in Mumbai (where probate is compulsory).

Figure 2

The lifecycle of a will can be divided into three stages:

- the planning stage;

- the execution stage; and

- the post-demise stage.

The most procedurally taxing stage begins when the testator dies. It is therefore critical that an executor is selected carefully, as they will bear significant responsibility in ensuring that the estate devolves as per the testator's wishes.

The executor will be responsible for obtaining probate of the will. Probate is granted under the seal of a court of a competent jurisdiction only to the executor appointed by the will. It is conclusive evidence of the validity and due execution of the will and the testamentary capacity of the testator. It is compulsory to obtain probate for the will of a Hindu, Parsi, Buddhist, Sikh or Jain executed in Chennai, Kolkata and Mumbai. Where a will is executed outside these territories, but for assets situated inside, it will still require probate.

Wills have their limitations, as they do not take effect until the testator dies. As such, they cannot address sudden lifetime contingencies. To plan for such circumstances, individuals may consider supplementing their succession plan with one of the following.

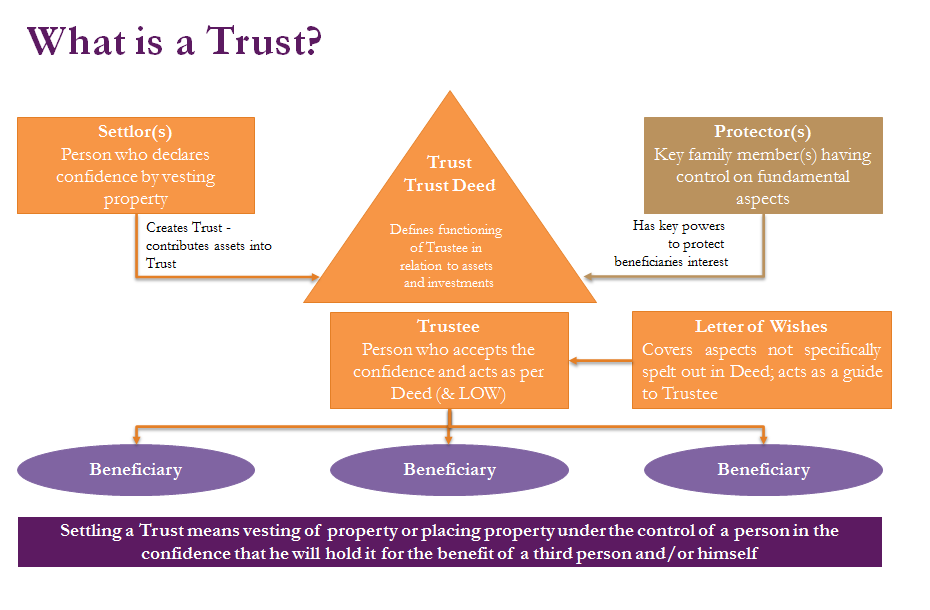

Private trusts A trust is one of the most sophisticated tools for effective long-term succession and governance planning. Trusts, particularly irrevocable discretionary trusts, are flexible in terms of the management and distribution of assets. They are commonly used by promoters of a family business, especially when they wish to retain a fair amount of discretion in terms of distribution or control. The convenience of trusts is that they are bespoke (ie, customisable for the unique circumstances of each family). By carefully selecting the best trustees, trust assets (including operating businesses) can be managed efficiently, with minimal burden on family members (but without effectively losing control over such assets). Assets transferred into a trust have an additional layer of protection from creditor claims and can help to isolate the assets from divorce claims. With large business houses in India being family owned, these features make trusts attractive.

Figure 3 sets out the nuances of trusts and the relevant parties involved.

Figure 3

Power of attorney For individuals who are quarantined due to COVID-19, their business interests and bank accounts will remain in limbo until they are deemed fit to be released. As such, executing a suitable power of attorney may help to ensure that things function smoothly during this time. One option is a special power of attorney, which is restrictive in nature to specified tasks or assets and remains in force until the specified act is completed. A power of attorney creates an agent-principal relationship under the Contract Act 1872 and can serve as an effective lifetime estate planning tool.

The recipient of such power must be chosen with due care as, depending on the scope of the power of attorney, they may be able to take control of the individual's financial affairs.

This tool can also be effectively implemented by non-resident Indians, who can determine a power of attorney (subject to following certain procedures) despite residing outside India and effectively delegate powers over Indian properties and Indian banking transactions to suitable persons in India. This significantly reduces the burden of travelling to India for administrative reasons, which will be difficult at present given the travel restrictions.

Comment

As medical professionals tirelessly endeavour to battle COVID-19, individuals must act prudently to secure the future of their loved ones. As discussed above, succession planning involves a number of complexities and nuances. The COVID-19 pandemic will hopefully abate shortly, but succession planning will have multi-generational ramifications. As such, individuals should plan sensibly and consult an attorney where necessary.

Endnotes

(1) For further details please see "Impact of COVID-19 on India Inc". In addition, for the latest updates on COVID -19, please visit the Ministry of Health and Family Welfare website.

(2) Further details on the importance of obtaining legal assistance if a will or estate is complex is available here.

(3) Notably, a will is aligned with any nominations which the testator has made during their lifetime. A detailed analysis on this matter is available here.