The government's new Job Support Scheme (JSS) replaces the furlough scheme and will start on 1 November 2020. This article answers FAQs, covering:

- eligibility;

- how the scheme works;

- what employers must agree with employees; and

- alternative resourcing options for employers.

The JSS will provide ongoing wage support for people in work, provided that:

- employers meet certain access conditions;

- employees are working at least 33% of their usual hours; and

- employers also provide additional wage support.

The JSS will start on 1 November 2020 and continue until the end of April 2021. The furlough scheme will end on 31 October 2020 as planned.(1)

The latest position regarding the JSS is as follows:

- The government has published a Winter Economy Plan which gives a brief outline of the scheme and a factsheet that explains its key components.

- Further details are expected shortly when the government publishes guidance on the scheme.(2)

Is the scheme open only to employers in defined sectors?

No, the JSS is not limited to any sectors or settings. It is open to all employers with:

- eligible employees;

- a UK bank account; and

- a UK pay-as-you-earn (PAYE) scheme.

Importantly, the JSS will be available to larger employers only if they meet a financial assessment test. (Small and medium-sized enterprises (SMEs) will not have to meet any financial test.)

Must employers prove that their trading conditions have been affected?

SMEs need not. However, large employers must demonstrate that their turnover is lower as a result of the COVID-19 pandemic.

At present, there are no further details of the financial assessment test and the timeframe for assessing lower turnover is unknown.

What if some parts of a business have been affected but not others?

SMEs will not need to pass any financial impact test and can access the JSS even if the pandemic has had an impact only on a small part of their business.

Larger businesses will need to pass a financial impact test. The details of this have not yet been released and it is unknown whether group companies will be assessed as a group on a consolidated basis.

What's the definition of an SME for these purposes?

This has not been announced yet. If it is based on the definition in the Companies Act 2006, it will mean (broadly) that a company would be defined as an SME if it meets at least two of the following requirements:

- annual turnover of £36 million or below;

- balance sheet total of £18 million or below; or

- 250 or fewer employees.

However, it is unknown whether this definition will be adopted or whether group companies will be looked at individually or assessed as a group. This will presumably be addressed in the forthcoming guidance.

Which employees can be on the scheme?

To be eligible for the JSS, employees must have been on their employer's PAYE payroll on or before 23 September 2020. This means that a real-time information (RTI) submission notifying payment to that employee to Her Majesty's Revenue and Customs (HMRC) must have been made on or before 23 September 2020.

Employees must work at least 33% of their usual hours. The government's factsheet states that the minimum hours threshold might be increased in February 2021.

Do employees need to have been furloughed to be put on the JSS?

No, the JSS is open to employers even if they have not previously used the furlough scheme and employees do not necessarily have to have been furloughed in order to be put into the JSS.

This means that, unlike the furlough scheme, the JSS is open to employees who have continued to work throughout the pandemic but on reduced hours. (The furlough scheme has allowed for part-time work since 1 July 2020, but is available only to employees who were fully furloughed with no work at all for at least three weeks before 1 July 2020.)

What if there is no work for some employees?

The minimum hours requirement is a key component of the JSS. If employers do not have enough work to provide even a third of an employee's usual hours, they cannot use the scheme. This has led to criticism of the scheme from industries such as live entertainment and sport, where jobs may be perfectly viable in the long run but in the short term due to COVID-19 restrictions there is simply no work. Other possible resourcing arrangements are covered below.

Can employers that think that they cannot guarantee 33% of usual hours every week still use the JSS?

It is currently unclear if employees must be working at least 33% of their hours every week or if this is an average over a month or longer period. However, the factsheet states that employees will be able to cycle on and off the scheme and do not need to be working the same pattern each month – although each short-time working arrangement must cover at least seven days. This suggests that employers may be able to move employees out of the JSS for periods in which they are not working 33% of their usual hours (although they would need to agree with their employees what will happen in those periods). Further guidance is awaited.

If employers put employees into the scheme, do they need to promise that they will not make them redundant for six months?

No, it does not appear that there will be any ban on making redundancies for the whole six months of the scheme. The factsheet states that employees cannot be made redundant or put on notice of redundancy "during the period within which their employer is claiming the grant for that employee". This suggests that employers would be able to move an employee out of the JSS and stop claiming the grant for them if they had to be made redundant before the scheme closed. (See below under "How the JSS works in practice" for further discussion of what this may mean in practical terms.)

Can employers claim the £1,000 job retention bonus while also claiming under the JSS?

Yes, employers can claim the £1,000 bonus for bringing a furloughed employee back to work in addition to claiming ongoing support for that employee under the JSS.(3) To qualify for the bonus, employees must remain continuously employed through to the end of January 2021 and earn an average of £520 per month over that period.

Can employers pay dividends to shareholders while claiming under the JSS?

The details released so far state that the government "expects" that large employers will not make capital distributions (eg, dividends) while using the scheme. It is unclear whether this is going to be converted into a legal requirement.

What about COVID-19-vulnerable employees who say that it is unsafe for them to come back to the workplace?

It is unclear how many employees there are who are currently fully furloughed who feel unable to return to the workplace because they are COVID-19 vulnerable or someone they live with is COVID-19 vulnerable. It seems that the 33% minimum hours requirement is a must, which will be an issue for these employees if they cannot work from home. This may generate disputes about whether it is safe for those employees to come back to work, but many may feel that they have little choice.

Employers should ensure that the workplace is COVID-19 secure and that they have carried out a thorough risk assessment that addresses the risks to such employees. If employers have taken all reasonably practicable steps to reduce the risk to an acceptable level and an employee is still unwilling to return, employers could consider a period of unpaid leave as an alternative to the JSS or redundancy. Potentially, employers could take the view that this is not a redundancy situation but rather a failure by the employee to obey reasonable instructions, although there may be some risks with taking that approach depending on the employee's circumstances.(4)

Who pays what under the scheme?

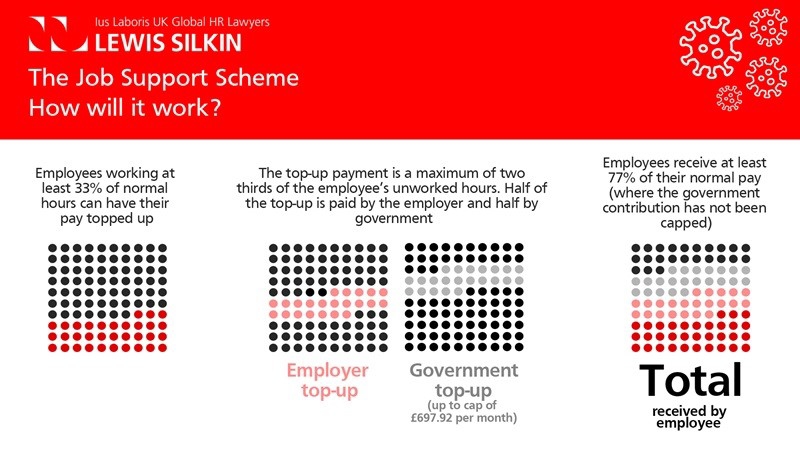

Figure 1 provides an at-a-glance summary of how the JSS will work. The idea is that employees working at least 33% of their usual hours can have their pay topped up.

Figure 1

The unworked time is essentially split into three:

- the employer pays for a third of the unworked time;

- the government also pays for a third of the unworked time (up to a cap); and

- the final third is unpaid (although it is unclear whether the employer can offer extra top-ups – see below).

This means that employees working the minimum 33% of their normal hours would receive 77% of their usual pay. Out of this 77%:

- 33% would be pay for the hours actually worked;

- 22% would be the employer top-up; and

- 22% would be the government top-up.

The government contribution is capped at £697.92 per month. It is unclear whether the cap will be reduced if an employee is working more than 33% of their normal hours.

The cap will affect employees who usually earn more than approximately £38,000 per year. For example, an employee who usually earns £45,000 and is working only a third of their usual hours will receive only £697.92 in government top-up, even though this represents less than one-third of their unworked hours.

The government contribution is considerably less than it was under the furlough scheme when it first opened, when the government supported 80% of an employee's wage costs up to a maximum of £2,500 each month.

What about national insurance and employer pension contributions?

The factsheet states that the grant will not cover Class 1 employer national insurance or pension contributions, although these contributions will remain payable by employers.

It seems most likely that employers will need to pay these contributions in respect of both the government top-up and the employer top-up, as well as in respect of pay for hours actually worked, but further guidance is awaited.

Does the top-up mean that employers are paying extra for reduced work?

Yes, the government factsheet gives the example of Beth, who normally works five days a week and earns £350 a week. The company puts Beth on the JSS working two days a week (40% of her usual hours). Her employer pays £140 for the days that she works. Her employer would also pay an additional £70 for the days that she does not work. Therefore, Beth's two days cost her employer £210, which is 50% more than they would normally cost. Pension and national insurance payments will likely also be on top of this – see above.

If the employer had three employees doing the same role as Beth, it would be cheaper (in terms of wage costs) to retain one of them full-time and make the other two redundant – as opposed to having all three employees working for a third of their usual hours.

However, the idea behind the JSS is that it is a way to keep jobs going and retain valuable skills and people over the next six months – in the hope that employees will be able to return to more normal hours by the time that the scheme closes. Employers will no doubt be weighing up the costs of retaining employees against the costs of making redundancies and then potentially having to re-hire and train new employees in the future.

What are the options for employers that cannot afford the top-up?

The employer top-up is a key component of the scheme, so if employers will be unable to afford this, they will need to look at other options – for example, agreeing a reduced working week without the extra financial support or redundancies (alternative options are discussed in more detail below).

Can employers offer extra top-ups?

This is unclear at present. The factsheet seems to imply that employees can be put into the scheme only if they agree to take a wage reduction, and the government's expectation is that employers cannot top up their employees' wages above the two-thirds contribution to hours not worked at their own expense. Therefore, it is currently unclear whether employers could offer an extra top-up at their discretion or whether they are going to be legally barred from doing so. It would be surprising if the government introduced a legal bar on employers making extra top ups, although few employers may in practice be able to afford to do so.

What do 'usual pay' and 'usual hours' mean?

The factsheet states that the usual pay calculations will follow a similar methodology as the furlough scheme. Employees who have previously been furloughed will have their underlying normal pay or hours used to calculate usual wages, not the amount that they were paid while on furlough. The detailed rules are expected to be set out in the forthcoming guidance.

Can employers agree a different working pattern each week?

Yes, it appears so. The factsheet states that employees "do not have to be working the same pattern each month, but each short-time working arrangement must cover a minimum period of seven days". This suggests that employers can claim for a different amount of unworked hours each week, subject to the employee working at least 33% of their usual hours.

What if there is a local lockdown and employees cannot work?

In the event of a local lockdown, some employers may have no work at all for employees in certain job roles. It is currently unclear what will happen under the JSS in these circumstances.

What if employees take holiday?

This is unclear but it is expected to be dealt with in the guidance. For example, it is unknown whether holidays will count towards the 33% minimum working hours or whether they will be treated as unworked hours. Employers may need to top up holiday pay in some cases to ensure that employees are receiving the correct statutory entitlement.

What if employees are sick or under official instruction to self-isolate?

Employees would be entitled to statutory sick pay in these circumstances, but it is unclear how time off sick will be treated under the JSS.

Can employers start redundancy consultation or put employees at risk of redundancy?

The factsheet states that employees cannot be "made redundant or put on notice of redundancy" during the period in which their employer is claiming the grant for that employee under the JSS. This indicates that employers will be able to start redundancy consultation and put employees at risk of redundancy while claiming for them under the JSS, provided that employers do not issue notice of termination of employment due to redundancy (see below). However, further clarity on this point in the guidance is awaited.

Can employers issue notice of redundancy or make employees redundant?

The factsheet states that employees cannot be "made redundant or put on notice of redundancy" during the period in which their employer is claiming the grant for that employee under the JSS. This suggests that employers can issue notices of redundancy or make employees redundant so long as they move them out of the scheme first. Further guidance is awaited, but employers may need to move employees out of the scheme before the beginning of the pay period in which they issue notice of redundancy.

How would employers calculate redundancy pay for employees in the JSS?

This is unclear. The government recently legislated to ensure that furloughed employees have their statutory redundancy payments calculated on the basis of their pre-pandemic pay, rather than the pay that they received while in the furlough scheme.(5) It seems likely that the government will extend the new rules to cover employees in the JSS but this has not been confirmed.

How do employers claim?

Employers will be able to make a claim under the JSS online from December 2020. The factsheet states that grant payments will be made monthly in arrears, reimbursing employers for the government's contribution. This means that a claim can be submitted only in respect of a given pay period after payment has been made and that payment has been reported to HMRC via an RTI return.

Can employees take another part-time job during the hours that their employer does not need them to work for them?

Furloughed employees have always been allowed to work elsewhere during their furloughed hours (subject to their contractual obligations to their main employer). It is unclear whether a similar principle will apply to the JSS, but it seems likely.

In what circumstances would employers have to repay the grant?

The factsheet states that HMRC will check claims, and payments may be withheld or need to be paid back if a claim is found to be fraudulent or based on incorrect information.

Grants can be used as reimbursement only for wage costs actually incurred so, if employers have not paid the government top-up to the employee as wages, they would also be liable to repay it.

What must be agreed with employees to put them in JSS

What agreements do employers need in place?

The factsheet states that employers must:

- agree the new short-time working arrangements with their staff;

- make any changes to employment contracts by agreement; and

- notify the employee in writing.

This agreement must be made available to HMRC on request.

What should the agreement cover?

The agreement will need to cover:

- the reduced hours that the employee will be working;

- the extra top-up pay that they will receive through the scheme; and

- what happens in respect of the unworked hours that are not covered by the top-up.

It should also cover the arrangements for moving the employee out of the JSS if necessary.

Employers may want to wait until the guidance is released and further details are available before finalising any arrangements with employees, although this must be balanced against the short window of time that is available before the scheme comes into effect on 1 November 2020. Employers that anticipate using the JSS on a large scale, or that are already in the course of redundancy consultations in relation to which the scheme may be viewed as an alternative, may feel that they have little choice but to move more swiftly.

Alternative resourcing options for employers outside JSS

Redundancies

If employers have some work, but not enough to keep everyone on their pre-pandemic hours, one option is to select some staff for redundancy while keeping others employed on their full hours. There is an argument that it is unfair to make employees redundant when a government-supported JSS is available as an alternative. However, the fairness of a redundancy dismissal depends on all of the circumstances at the time, including the employer's resources. It will not necessarily be unfair to make employees redundant instead of using the JSS, particularly given the additional costs incurred by the employer in making use of the scheme.

Reduced hours working outside of the scheme

Another option is to agree a reduced working week with employees that does not involve putting them into the JSS. For example, it would be possible to agree with an employee that they will work for a third of their original normal hours and be paid for those but without seeking recourse to any further top-ups under the JSS. Any proportion of working hours could be agreed under such an arrangement and it would not require a minimum of 33% hours. Employers could even offer a top-up.

However, from employees' perspectives this is a much less attractive arrangement. Unless employers' underlying agreement with employees allows for reduced hours or sets no minimum normal hours, this sort of agreement will need to be negotiated with employees.

Unpaid leave

It is possible that some employees will prefer a period of unpaid leave to redundancy or reduced hours working – for example, if they are COVID-19 vulnerable and do not want to go to the workplace at the moment. This might even be a reasonable adjustment if the employee is disabled within the meaning of the Equality Act 2010.(6) For a more detailed discussion of this issue, see our FAQs on staffing decisions when reopening workplaces.

Endnotes

(1) For further information please see "Furloughing employees - FAQs for employers on the coronavirus job retention scheme".

(2) This article is being maintained on an ongoing basis here.

(3) For further information please see "Government to pay bonus for retaining furloughed workers".

(4) For further information please see "Coronavirus – FAQs on staffing decisions when reopening workplaces".

(5) For further information please see "New law on redundancy and notice pay for furloughed employees".

(6) For further information please see "Coronavirus – FAQs on staffing decisions when reopening workplaces".