On 18 September 2018 the Dutch Banking Association (NVB) published a standard form for a deed of right of superficies (the model deed). The model deed was introduced to promote the financing of solar panels on company roofs in the Netherlands. This article examines the background, use and objectives of the model deed.

In September 2013 the government concluded the Agreement on Energy for Sustainable Growth (the Energy Agreement, the predecessor of the Climate Agreement, concluded on 28 June 2019) with more than 40 Dutch organisations, including regional and local governments, employers, environmental organisations and financial institutions. The Energy Agreement's main goals are to:

- increase renewable energy's share in the Netherlands' total energy consumption to 16% by 2023 (the current expectation is that this will be 14% in 2020 and 17.3% in 2023); and

- effectuate energy savings of 1.5% per year (creating a reduction of 100 picojoules by 2020).

The Energy Agreement comprises 12 pillars with specific objectives in order to achieve its goals. The 10th pillar (the financing of sustainable investments) aims to overcome barriers for financial institutions when financing renewable energy projects and energy-saving projects. When the Energy Agreement was concluded, it was clear that certain bottlenecks in the Netherlands complicated or prevented the financing of these projects.

To meet the objectives of the 10th pillar of the Energy Agreement, the NVB, which is also a party to the Energy Agreement, concluded a so-called 'Green Deal' in 2013 with the Ministry of Economic Affairs and the Ministry of Infrastructure and the Environment. The Green Deal aimed to implement concrete measures to promote the financing of renewable energy projects and energy-saving projects.

Following the Green Deal, one of the measures that was implemented by the NVB – in collaboration with various Dutch banks, the Netherlands Enterprise Agency and parties from the solar panel industry, among others – was the introduction of the model deed. The model deed has been developed to promote the financing of Dutch rooftop solar projects (for company roofs – the model deed is not suitable for homes) by balancing the needs of the various (financing) parties involved in such projects.

Innovative ownership structures in solar rooftop projects

The parties to the Green Deal concluded that one of the reasons that renewable energy projects in the Netherlands are often unsuccessful is that financial institutions have insufficient insight "into the business case and the contracts between suppliers and buyers for sustainable energy projects with an innovative ownership structure, such as decentralized sustainable energy cooperatives and Energy Service Companies (ESCos)".

'ESCos' are commercial businesses that provide a broad range of energy solutions for building owners, including:

- introducing energy management (monitoring) in order to realise energy savings based on measurement data (ESCo light services); and

- taking over all or part of the energy system of a building by:

- implementing one or two energy-saving measures, such as installing LED-lighting or solar panels (product ESCo services);

- focusing on more comprehensive energy-saving measures, such as in relation to a building's climate systems (installation ESCo services); and

- focusing on energy-saving measures in relation to a building's structure (building ESCo services).(1)

The relevant building owners (often small and medium-sized businesses, as well as farmers, housing corporations and hospitals) typically want to incorporate energy-saving measures in their building but lack the knowledge, time or funds to do so. ESCos provide the solution here.

ESCos (unless they provide light services only) install and operate renewable energy installations, such as solar panels on the rooftop of a building, while maintaining the ownership of such installations. Due to this ownership structure, the building owner can purchase green energy, saving itself the burden of investing in, installing and operating the installations. The building owner pays the ESCo for its services from the cash flow available due to lower energy costs.

As an additional advantage for building owners, ESCos often provide off-balance sheet financing solutions to implement energy solutions by attracting financing from banks, crowdfunding platforms and sustainability funds. As the debt will appear on an ESCo's balance sheet (as the owner of the installations) instead of the building owner's, the building owner is safeguarded from the financial risks associated with an energy-saving project.

Given the potential energy savings that could be realised by 'greening' the rooftops of Dutch companies, the parties to the Green Deal concluded that the financing of ESCos (or similar ownership structures) should be facilitated. The development of the model deed is one of the initiatives that aims to meet this objective. Pursuant to the model deed, a building owner creates a right of superficies over a building, preventing the solar panel owner (eg, an ESCo) from losing its ownership over the solar panels to the building owner (by way of accession) once the solar panels have been installed.

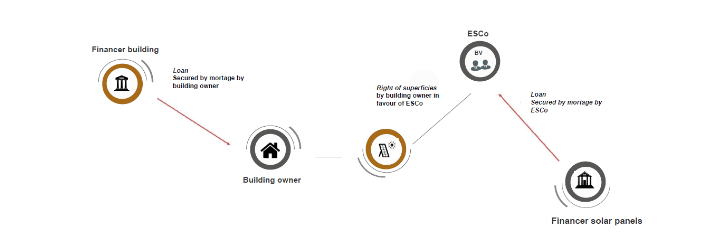

Besides the creation of a right of superficies (which, on its own, is fairly standard in the Netherlands), the model deed contains various contractual arrangements that aim to balance the interests of the various (financing) parties involved in rooftop solar projects (Figure 1) that use an ESCo or a similar ownership structure.

Figure 1: Parties involved in solar rooftop projects (ESCo structure)

In general, the parties' steps are as follows:

- the building financier provides a loan to the building owner, which is secured with a right of mortgage;

- the building owner wishes to install solar panels on its rooftop and enters into an agreement (an energy performance contract) with an ESCo. In order to create a right of superficies on its building in favour of the ESCo (so that the ESCo can maintain its ownership rights to the solar panels), the ESCo requires the prior consent of the building financier;

- the ESCo requires funds to finance the solar panels and enters into a financing arrangement with the solar panel financier; and

- the solar panel financier wishes to secure its loan with a right of mortgage over the right of superficies (as well as a change of priority, as detailed below).

Not only will the solar panel financier request a mortgage over the right of superficies, it will also require a change of priority between:

- the right of mortgage over the building; and

- the right of superficies (and the right of mortgage created on top thereof in favour of itself).

Without a change of priority, the building owner would – in the event of a foreclosure of the right of mortgage over the building and a subsequent sale of the building by the financier – suddenly become the owner of the solar panels (as a result of the right of superficies ceasing to exist on foreclosure), leaving the ESCo and the solar panel financier with empty hands. A change of priority ensures that the right of superficies will stay in place in case of a foreclosure event.

The change of priority is usually a topic of heavy debate between building and solar panel financiers. Unless they are familiar with ESCos or similar ownership structures, building financiers are often reluctant to accept such a change.

Article 21 of the model deed deals with this issue as it includes a change of priority between the right of mortgage of a building owner and the right of superficies. To accept the change of priority, the building owner must become a party to the deed of right of superficies.

By arranging (and thereby standardising) the abovementioned change of priority and by balancing the various other interests (see below) of the parties involved in rooftop solar projects pursuant to the model deed, the NVB expects that the willingness of such parties to provide their cooperation to (and the financing of) rooftop solar projects will increase. Further, the expectation is that by standardising the legal documentation, the parties involved will know what to expect in terms of documentation, resulting in fewer negotiations and lower related transaction costs.

Other interests that are covered by the model deed include:

- the maintenance of the solar panels and the roof and access to the roof;

- solar panel insurance;

- building and legal insurance;

- the right of an ESCo (or a similar party) to make use of the power connection of the building owner;

- the liability of parties; and

- the end of the right of superficies (whether or not by cancellation) as well as the right of removal of the solar panels or removal obligation at the end of the right of superficies.

The model deed is a great starting point for discussions between the parties involved in rooftop solar projects. The model deed has been well received among market participants and has already facilitated negotiations (especially regarding the change of priority topic) among parties involved in solar rooftop projects.

The NVB aims to evaluate the model deed later in 2019 in order to implement any further required changes. Moreover, the NVB plans to develop standardised documents in respect of rooftop solar projects that involve lease and ground structures. The NVB's efforts to contribute to the Netherlands' Energy Agreement goals are welcomed and the sector is looking forward to these future developments.

Endnotes

(1) Further information on ESCo services is available here (in Dutch).

This article was first published by the International Law Office, a premium online legal update service for major companies and law firms worldwide. Register for a free subscription.